Introduction to Crypto-Backed Lending in 2025

Crypto-backed lending allows borrowers to access liquidity without selling their digital assets. Instead of liquidating holdings, investors can use cryptocurrencies like Bitcoin and Ethereum as collateral to secure finance. This type of financial arrangement offers a flexible solution while preserving long-term investment potential.

Why Crypto-Backed Lending Matters in 2025

Why Crypto-Backed Lending Matters in 2025

As the crypto market matures, more investors seek ways to leverage their holdings without exposing themselves to unnecessary tax implications or market timing risks. Crypto-backed loans provide access to cash without the need to sell, offering an alternative to traditional financial services.

How Crypto Loans Work & Their Growing Popularity

How Crypto Loans Work & Their Growing Popularity

Crypto financing works similarly to secured loans in traditional finance. Clients deposit cryptocurrency as collateral, and loans are issued based on a loan-to-value (LTV) ratio. If market volatility causes the collateral value to drop, clients may need to add more crypto or cash to maintain the required LTV—or risk liquidation. This structure makes crypto lending both an attractive and a carefully managed financial tool.

Why Private Lenders and Banks Are a Better Choice

Why Private Lenders and Banks Are a Better Choice

Finance companies and traditional lenders offer significant advantages over platform-based lending. They provide non-recourse loans, meaning borrowers are not personally liable beyond the collateral. Interest rates are typically fixed between 3-6%, ensuring cost certainty. Loan terms generally extend beyond two years, offering greater stability. Unlike automated platforms, private lenders use sophisticated risk management strategies to avoid immediate liquidation during market swings. This structured approach provides predictability and financial security, making private lending a more reliable option.

Crypto Backed Lending Market Growth

Crypto-backed lending is an increasingly popular financial solution, with the market seeing rapid growth. According to a report by Grand View Research, the global crypto lending market size was valued at USD 5.7 billion in 2024, and it is expected to expand at a compound annual growth rate (CAGR) of 13.1% from 2025 to 2030. This growth is driven by the increasing adoption of cryptocurrencies and the desire for investors to leverage their holdings without liquidating assets.

The rise of institutional interest in digital assets, along with the expanding use cases for crypto lending has contributed to this surge. High-net-worth individuals (HNWIs) and institutional investors are particularly attracted to the flexibility crypto loans provide, which allows them to maintain their crypto portfolios while accessing cash.

Key Takeaways

Crypto-backed lending is an evolving financial tool that offers a unique way to access funding while keeping your digital assets intact. However, investors should be aware of the following key considerations:

-

- Access Capital Without Needing to Sell: Crypto based loans enable borrowers to access cash without liquidating their assets, maintaining long-term investment potential.

-

- Market Volatility Risk: Fluctuations in cryptocurrency prices can impact loan-to-value ratios, so it’s essential to manage risk by monitoring your collateral closely.

-

- Security & Trustworthiness: Choosing a reputable lender with strong security measures and regulatory compliance is crucial to safeguard your assets.

-

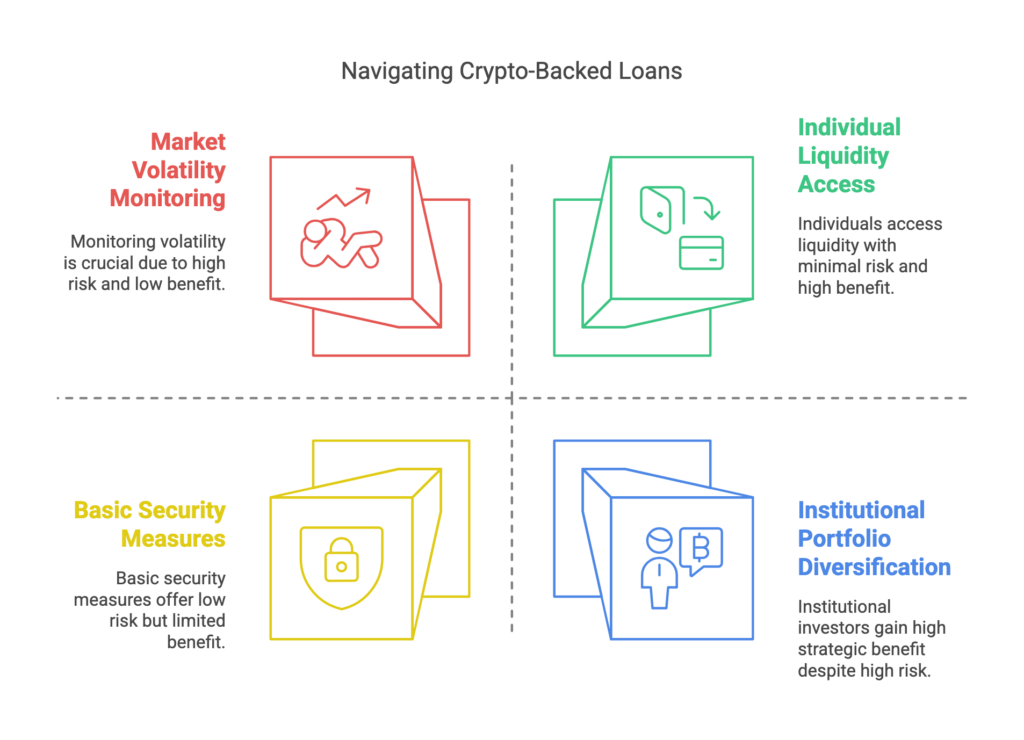

- Popular Among HNWIs & Institutions: High-net-worth individuals and institutional investors are leveraging crypto-based loans for portfolio diversification and business financing, all while holding onto their crypto assets.

-

- Careful Loan Structuring: Understanding loan terms, interest rates, and repayment strategies is vital to avoid over-leveraging and ensure a sustainable financial approach.

Strategies for Using Crypto-Backed Lending

Unlocking Liquidity Without Selling Your Digital Assets

Volatile markets can make selling crypto a risky decision. With a crypto based loan, borrowers can unlock capital without needing to sell, maintaining their position in the market while accessing cash when needed.

The Role of Crypto Based Loans in Wealth Management

High-net-worth individuals (HNWIs) and institutional investors use crypto-based loans to optimize liquidity, rebalance portfolios, and diversify investments. This strategy allows them to access funds for new opportunities while keeping their crypto holdings intact:

Case Study 1:

A tech entrepreneur holding $5 million in Bitcoin needed $1.5 million for a real estate investment without triggering a taxable event. Through a non-recourse crypto based loan with a 5% fixed interest and 3-year term, she accessed the needed capital while maintaining her long-term Bitcoin position.

When Bitcoin’s value increased 70% during the loan term, she retained all appreciation while having deployed capital elsewhere.

Case Study 2:

A family office managing $20 million in digital assets secured a $6 million non-recourse loan against a diversified crypto portfolio. With a 4.5% fixed interest over 24 months, they funded a private equity opportunity while their crypto holdings remained intact through market depreciation, protected by sophisticated risk hedging rather than automatic liquidation triggers.

Challenges & Common Pitfalls of Crypto-Based Loans

Market Volatility & Risk Management Strategies

Cryptocurrency prices are highly volatile, affecting the asset value. Borrowers must monitor their loan-to-value ratio closely to avoid margin calls or liquidation events.

Loan-to-Value (LTV) Ratios and How They Impact Your Loan

To determine LTV ratios based on asset risk and liquidity. Typically, LTV ratios range from 30% to 70%, meaning a borrower with $1,000,000 in Bitcoin may receive a loan between $300,000 and $700,000, depending on the terms of the loan agreement.

Avoid These Common Mistakes When Using Crypto as Collateral

-

Failing to monitor collateral value during market fluctuations

-

Ignoring loan fees and interest payments

-

Choosing loan provider without strong security practices and professional custody

-

Over-leveraging assets without considering repayment strategies

Crypto-Based Lending vs. Asset-Based Finance

How Cryptocurrency Loans Compare to Securities-Based Loans

While securities-based loans use traditional assets such as listed stocks, as collateral, digital asset-backed financing is secured against digital assets. Both provide fast access to funds but differ in regulatory oversight and risk profiles.

Liquidity Strategies for HNWIs & Institutional Investors

Institutions and HNWIs use crypto-based loans for various strategies, including:

-

- Portfolio diversification– Accessing funds without the sale of core assets. Perfect for rebalancing concentrated risk.

-

- Business financing– Using crypto for operational expansion

-

- Arbitrage opportunities – Borrowing against stablecoins for yield generation

Frequently Asked Questions:

-

- What is the typical APR for crypto based loans? Rates vary but typically range between 3% and 12%, depending on the collateral type and market conditions, and the type of lender.

-

- Can I use any cryptocurrency as collateral? Most financiers accept Bitcoin, Ethereum, and stablecoins like USDC. Some support additional assets, such as top 50 but availability may vary.

-

- What happens if the value of my crypto drops? If the collateral value declines, a borrower may receive a margin call, requiring additional collateral or cash to top up the LTV. If the borrower fails to respond, their assets may be liquidated to cover the loan.

-

- What jurisdictional considerations should I be aware of when seeking crypto-backed loans? Traditional lending services operate internationally with varying eligibility requirements based on jurisdiction. Most sophisticated firms work with international clients across Europe, Asia, the Middle East, and select other regions, focusing on markets with clear regulatory frameworks. Before applying, confirm whether your jurisdiction is supported by your preferred firm.

-

- How long does it take to get a crypto loan? Some platforms offer instant cash (typically at double figure, variable rates), while more traditional types of lenders may take a few weeks to process, depending on the asset, verification measures and credit score, but the rates are typically low single figures and fixed.

Conclusion

Crypto-backed lending has emerged as a powerful financial tool, offering investors access to liquidity without selling their digital assets. As the market matures, sophisticated lending solutions provide an alternative to platform-based loans, ensuring stability, fixed interest rates, and professional risk management. Whether used for portfolio diversification, business expansion, or wealth management, crypto-backed loans allow high-net-worth individuals and institutions to unlock capital while preserving their long-term holdings.

By carefully selecting reputable lenders, understanding loan terms, and managing collateral effectively, borrowers can navigate the evolving landscape of crypto-based finance with confidence.

Next Steps

Ready to leverage your crypto assets without the risks of platform-based lending? Our tailored lending solutions connect qualified borrowers with established financial institutions offering non-recourse loans, fixed low-single-digit interest rates, and terms of 2+ years or longer.

Unlike automated platforms, our lending partners employ sophisticated risk management without relying on immediate liquidation triggers.

Contact Us Today to explore how our tailored approach to crypto-backed lending can help high-net-worth individuals and institutions access liquidity while preserving long-term investment potential in digital assets.

We work with clients across UK, Europe & Asia-Pacific, and elsewhere on a case-by-case basis

Why Crypto-Backed Lending Matters in 2025

Why Crypto-Backed Lending Matters in 2025 Failing to monitor collateral value during market fluctuations

Failing to monitor collateral value during market fluctuations