CRE Financing Guide 2025: A Practical Overview for Investors and Developers

In the dynamic 2025 commercial real estate market, securing capital is more than a transaction—it’s a strategic imperative. For property developers, investors, C-suite executives, high-net-worth individuals (HNWIs), the ability to navigate complex capital structures is the critical factor that separates marginal returns from market-leading success. As interest rates fluctuate and market dynamics evolve, a sophisticated approach to CRE financing is no longer an advantage; it’s essential for portfolio growth and risk mitigation.

This CRE financing guide moves beyond the CRE financing fundamentals. It is designed as a strategic primer for decision-makers looking to optimise their investment strategy, whether for property acquisition, a new development project, or refinancing an existing asset. We will explore the nuances of structuring deals, mitigating risks, and aligning commercial real estate finance with your broader corporate or wealth management objectives.

CRE Financing Guide: Understanding the Modern Landscape as a Strategic Asset

For the sophisticated investor, commercial real estate is a cornerstone asset class, offering unique opportunities for leverage, cash flow optimisation, and portfolio diversification. Understanding the mechanics of CRE financing is not merely about securing a loan; it’s about deploying capital as a strategic tool.

A well-structured commercial mortgage or CRE financing package can:

- Enhance Purchasing Power: Utilise leverage to acquire larger or higher-value income-producing properties.

- Optimise Cash Flow: Align loan terms, amortization schedules, and debt service coverage with the property’s projected rental income and operational expenses.

- Create Tax Efficiencies: Leverage potential deductions on mortgage interest payments and asset depreciation, enhancing the overall return profile of your investment strategy.

- Strengthen Corporate Finance: For business entities, property acquisition can be a key component of an expansion strategy, with the physical property serving as valuable collateral.

Industry Insight:

UK commercial real estate lending rebounded in 2024, with new loan volumes up 11% year-over-year, reaching £36.3 billion, led by strong Q4 activity and easing base rates UK banks secured 46% of that total, with international banks contributing 31%, while debt funds provided 17% of new lending. This trend mirrors similar growth in Europe. In APAC, rapid urbanisation and infrastructure investment continue to fuel competitive CRE financing from both banks and alternative lenders, underscoring why strategic capital planning is essential. Source: CoStar News

CRE Financing Guide: A Strategic Checklist for Securing the Right Capital

Achieving exceptional returns requires a meticulous and proactive CRE financing approach. This checklist outlines the critical steps for navigating the commercial real estate finance process effectively.

1. Develop a Comprehensive Investment Thesis and Business Plan

Lenders and capital partners require more than just numbers; they need a compelling narrative. Your business plan must be a rock-solid document that articulates:

- Investment Strategy: Clearly define the objective (e.g., value-add, core-plus, development) and target tenant profile.

- Financial Projections: Provide realistic, stress-tested projections for cash flow, net operating income (NOI), and potential exit value.

- Market Analysis: A comprehensive guide to the submarket, including competitive landscape, demographic trends, and economic drivers.

- Risk Mitigation: Identify potential risks (market, operational, tenant) and outline clear mitigation plans.

2. Master Key Underwriting Metrics from a Lender’s Perspective

Your CRE financial strength and the property’s viability are scrutinised through key financial ratios. Understanding how lenders underwrite a deal is crucial.

- Loan-to-Value (LTV) Ratio: This measures the loan amount against the property’s appraised value. Lenders favour lower LTVs (typically 65-80%) as it signifies lower risk and higher borrower equity.

- Debt-Service Coverage Ratio (DSCR): This is a critical measure of the property’s ability to generate sufficient cash flow to cover its mortgage payments. A DSCR of 1.25x or higher is the standard benchmark, proving the income-producing asset can comfortably meet its debt obligations.

- Formula: Net Operating Income (NOI) ÷ Total Debt Service

A strong credit history and proven creditworthiness are paramount. As this CRE Financing Guide underscores, these factors directly influence the interest rates you’re offered and the flexibility of your financing terms.

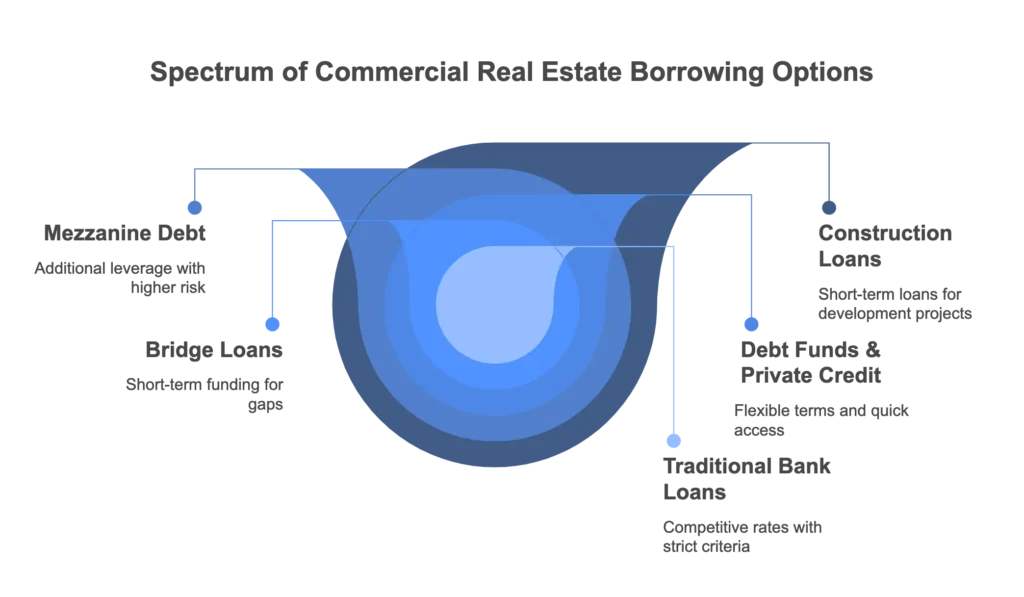

3. Evaluate the Full Spectrum of CRE Financing Options

Never accept the first offer. A competitive process is essential. Explore a diverse range of financing options to find the structure that best aligns with your project timeline and risk tolerance.

- Traditional Bank Loans: Offered by commercial banks and credit unions, these are standard commercial mortgage products with competitive rates for creditworthy borrowers.

- Bridge Loans: Short-term type of financing used to acquire a property quickly or fund renovations before securing long-term, stabilised financing. They offer speed but often come with higher interest rates.

- SBA Loans (SBA 504 & 7a): Government-backed loans from the Small Business Administration designed for owner-occupied commercial property. The SBA 504 loan is particularly useful for acquiring major fixed assets.

- Hard Money Loans: Asset-based loans from private investors or companies. Approval is fast and based on the value of the property being purchased, but these carry higher costs and shorter terms.

- Mezzanine Financing & Private Equity: For larger development projects, this subordinate debt or equity sits between senior debt and the developer’s equity, filling a crucial gap in the capital stack.

Industry Insight:

The latest CRE Financing Guide from JLL highlights a widening debt gap across Asia Pacific, estimated at over US $257 billion due to tighter bank lending standards. As a result, non-bank lenders and private credit funds are stepping in, offering flexible capital for both value-add and stabilised assets. This shift underscores the need for a diversified financing strategy in today’s evolving market.

Source: JLL Asia Pacific Capital Tracker

Mitigating Risk: Navigating Common Pitfalls in the 2025 CRE Market

Even seasoned investors can face obstacles. This CRE Financing Guide emphasises proactive risk management as a critical factor in protecting capital and ensuring project success.

- Underestimating Total Project Costs: Always budget for closing costs, appraisal fees, legal counsel, and a significant contingency fund (10-15%) to absorb unexpected expenses.

- Inadequate Due Diligence: Go beyond a superficial review. A thorough investigation must include environmental assessments, zoning compliance, a full audit of tenant leases, and a structural engineering report.

- Overly Optimistic Projections: Lenders will stress-test your cash flow projections. Ensure your model can withstand a rise in vacancy or a dip in rental income without defaulting on mortgage payments.

- Ignoring Market Volatility: The global economic climate directly impacts interest rates and property valuations. For investors in the UK and Europe, factors like ECB monetary policy add complexity. In the Asia-Pacific region, rapid urbanisation and regulatory shifts present unique opportunities and risks. Stay informed to adapt your investment strategy.

Mastering the nuances of commercial real estate financing, with this CRE financing guide, is the key to unlocking value and navigating these challenges effectively.

Your Strategic Partner in Commercial Real Estate Investment

Navigating the complexities of the CRE financing guide as outlined above requires expertise, relationships, and strategic foresight. Structuring deals to maximise returns while minimising risk is a specialised skill.

At Forbes Le Brock, we don’t just arrange CRE financing, we help engineer tailored capital solutions for developers of luxury multifamily projects, high end condos, retail centres, and hospitality ventures. Our personalised approach ensures your vision receives the customised funding strategy it deserves. We leverage our extensive network of commercial real estate lenders, from traditional bank loans to private capital from pension funds, to negotiate terms that align with your project’s unique needs.

Conclusion: From Financing to Strategic Capital Allocation

This CRE financing guide demonstrates that securing capital is a strategic function, not a commoditised process. By developing a robust investment thesis, mastering underwriting metrics, and exploring the full spectrum of financing options, you position yourself to make informed decisions that drive superior returns.

For Property Developers, Real Estate Investors, C-suite leaders and HNWIs, the right financing partner does more than find a loan; they integrate the capital structure into your broader business and financial strategy, ensuring long-term success.

Ready to elevate your CRE investment strategy? Contact our team at Forbes Le Brock for a personalised consultation.

Our experts are ready to help you navigate the complexities of CRE financing and secure the optimal capital structure for your next venture in the UK, Europe, or Asia-Pacific.

🧠 Want to hear others’ take on our CRE Financing Guide? Listen to this Deep Dive for the highlights.🎙️

FAQs: Common Questions from Investors and Developers

- What types of commercial property are eligible for financing? CRE financing is available for a wide range of types of commercial real estate, including office buildings, industrial facilities (warehouses, distribution centres), retail spaces, and multifamily properties. The terms offered by a lender will vary based on the specific asset class.

- What are the primary commercial real estate loan options? Key options include traditional commercial mortgage loans from commercial banks, short-term bridge loans, structured finance, mezzanine finance and private hard money loans. The best choice depends on your project timeline, risk profile, and the property being purchased.

- What is a typical down payment for a commercial property loan? Borrowers are generally required to provide a down payment of 20-40% of the purchase price. The exact amount depends on the loan-to-value (LTV) ratio offered by the lender, your creditworthiness, and the property’s perceived risk.

- How does amortization work in commercial real estate financing? Amortization is the schedule for paying off a loan over time. CRE loans are typically structured with amortization periods of 20-25 years, but often have a shorter term (e.g., a 5- or 10-year balloon), meaning the remaining balance is due at the end of the term.

- What is the Debt-Service Coverage Ratio (DSCR) and why is it important? The DSCR (or debt service coverage ratio) is a key metric lenders use to assess if a property’s rental income can cover its monthly payments. A ratio of 1.25x or higher indicates a healthy cash flow buffer, which is a critical factor when a lender decides whether to extend a loan.

- How do I effectively compare different commercial loan offers? Investors should compare interest rates, LTV ratios, amortization periods, fees, and any prepayment penalties. It’s crucial to model the long-term financial impact of each offer to select the type of financing that best supports your investment goals.