The Banco Central Burglary: Brazil’s Wildest Heist and a Lesson for Raising Capital in 2025

The Banco Central Burglary in Fortaleza, Brazil, was one of the largest heists in history. Thieves tunnelled over 250 feet into the Central Bank vault in 2005, stealing $70 million. Here’s what it teaches us about capital, risk, and smarter funding in 2025

Picture this: Fortaleza, Brazil, back in 2005. A group of guys rent a small storefront right in the bustling city centre. They hang a sign: “Grama Sintética” – Synthetic Grass. Seems legit, right?

For the next three months, neighbours saw trucks coming and going, hauling away load after load of dirt and rubble – over 70 metric tons in total, apparently! People figured, “Hey, landscaping business, lots of digging, makes sense.” Nobody batted an eye.

But behind that innocent-looking facade, something far more ambitious was happening.

The Banco Central Burglary – Brazil’s Wildest Heist?

Inside the shop, these weren’t landscapers; they were a gang of thieves. They dug downwards, then horizontally, carving out an underground passage that eventually stretched:

- Nearly 80 meters (about 260 feet) long – almost the length of a football pitch!

- Just 70 centimetres (about 2.3 feet) high – definitely not built for comfort.

- Painstakingly reinforced with wood beams and plastic sheeting.

- Impressively equipped with electric lights, ventilation, and even basic air-conditioning.

Building this subterranean highway cost them an estimated R$500,000 (around $200,000 USD at the time) – a serious chunk of seed capital for their… enterprise.

And their target? The vault of the Banco Central in Fortaleza, Brazil, (Banco Central do Brasil) the country’s central bank branch.

Over the weekend of August 6th and 7th, 2005, while the city above enjoyed its weekend, the crew finally broke through the meter-thick, steel-reinforced concrete floor of the bank vault. The tunnel emerged precisely where they planned.

Ingeniously, the thieves bypassed the motion sensors and alarms. The cash inside – stacks and stacks of used 50-real notes – had been taken out of circulation and wasn’t sequentially marked, making it incredibly hard to trace. It was the perfect score.

They worked quickly, clearing out an estimated 164.7 million Brazilian reais. At the 2005 exchange rate, that was a staggering $70 million USD.

By Monday morning, they were gone, leaving behind an empty vault and one of the most audacious bank heists in history. Despite massive investigations, only about $8-9 million USD worth of the cash was ever recovered form the theft.

The Head-Scratcher (aka The “Dumb” Part?)

Every time I hear about this incredible feat of engineering, logistics, and sheer nerve, I can’t help but think:

Imagine if they’d put that same ingenuity, planning, discipline, and capital into a legitimate business?

They clearly weren’t afraid of hard work or complex projects. They managed logistics, secured funding (albeit likely through shady means initially), executed a multi-month plan under extreme secrecy, and achieved a technically brilliant outcome. They could have built something amazing, something legal. Instead, they chose the high-risk, high-stakes criminal path.

What Bank Robbery Teaches Us About Raising Capital in 2025

Now, obviously, applying for a business loan isn’t criminal. But sometimes, the sheer effort and frustration involved can feel almost as complex as digging that tunnel!

Traditional Lending Feels Like Digging a Tunnel

I’ve seen too many entrepreneurs and business owners spend 6 to 9 months (or longer!) navigating the maze of traditional capital raising:

- Endless bank applications demanding mountains of paperwork.

- Constant requests for more documents, often feeling arbitrary.

- Frustratingly vague rejections with little explanation.

- Getting stuck in the dreaded “we’re still reviewing your file” limbo.

All that time, energy, and focus diverted… often for a disappointing “no,” or maybe, just maybe, a restrictive line of credit months after the opportunity has passed. It’s a massive drain on resources and morale.

How to Raise Capital Using Listed Securities

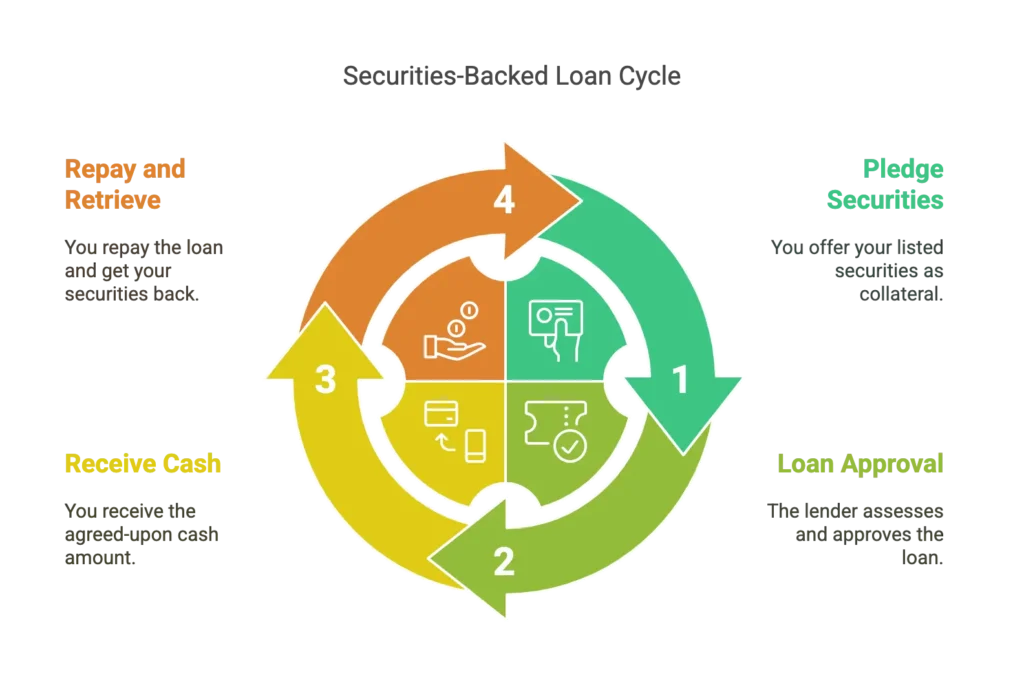

Securities-Backed Lending: Fast, Flexible, No Selling Required

What if you could access significant capital without the months-long ordeal? If you own publicly listed stocks or securities that meet some basic liquidity criteria, you often can.

Instead of digging a metaphorical tunnel through bank bureaucracy, you can leverage assets you already own – without selling a single share.

Here’s how our approach differs:

- Speed: We move fast. Think funding in weeks, not 6-9 months.

- Simplicity: Forget digging up years of personal or business tax returns. We typically don’t need them.

- Focus: No personal credit review is required for the loan itself.

- Security: We’re fully capitalised lenders, not brokers looking to sell your stock. Your portfolio stays yours.

- Outcome: You get the capital you need, and your stock is returned at the end of the loan term.

We’ve helped businesses navigate challenging times and seize growth opportunities using this method. For example, we assisted a shipping company in securing crucial funding during the COVID pandemic disruptions. They didn’t just survive – they thrived.

Conclusion: Why Securities-Based Lending is a Smarter Move in 2025

You don’t need to mastermind a complex heist to unlock the capital tied up in your assets. And you definitely don’t need to waste precious months battling outdated, slow-moving lending systems.

If you hold listed securities and need capital for your business, a personal project, or simply for liquidity, there’s likely a much more direct path available.

Ready to explore a faster, simpler way to raise capital?

Serving clients across UK, Europe & Asia-Pacific

👉 Book a no-obligation strategy call with Forbes Le Brock today here

FAQs: The Banco Central Burglary and Modern Lending Alternatives

Q: How much was stolen in the 2005 Banco Central Burglary?

Around 164.7 million reais ($70 million USD) was stolen. Only about $9 million was recovered.

Q: What is a securities-based loan?

A loan where you use your listed stocks or securities as collateral without selling them.

Q: Is this type of loan risky?

Like any financial product, it depends on how it’s structured. We ensure the loan is fully secured and non-recourse.

PS: Know any other wild stories of incredible effort (misguided or not)? I’m always looking for fascinating tales. Share them in the comments or shoot me a message – maybe it’ll inspire the next post!

🎙️ Prefer an audio summary? Check out the podcast discussion for a deeper dive into the blog post’s content. 🎧 Listen now!