Private Jet Financing Options: How to Fund, Lease, or Leverage Your Aircraft

Introduction to Private Jet Financing

Owning a private aircraft represents exclusivity and convenience, providing unmatched flexibility in travel. However, with the high costs involved, securing private jet financing is crucial for buyers. This article delves into the various methods of acquiring a private aircraft, including loans, leaseback options, and alternative funding structures, while also highlighting the key factors loan underwriters evaluate when making approval decisions.

Types of Private Aircraft Financing

✅ Traditional Loans

A traditional loan functions similarly to a mortgage, where the borrower secures funding from a bank or private bank. These loans typically have the following features:

- Loan-to-Value (LTV) Ratios: Bankers generally offer loans covering 70–85% of the aircraft’s purchase price.

- Fixed or Floating Interest Rates: Interest rates can be fixed for stability or floating, often tied to SOFR.

- Repayment Terms: Usually structured between 5 and 10 years, with balloon payments in some cases.

- Collateral: The aircraft itself serves as collateral, reducing the risk.

✅ Operating Leases

This is ideal for those who want the benefits of an executive aircraft without ownership responsibility. Features include:

- Lower Upfront Costs: No large down payment required.

- Short-Term Commitment: Typically 3–7 years, making it suitable for businesses that want to upgrade frequently.

- Off-Balance-Sheet Treatment: Can provide tax benefits depending on jurisdiction.

✅ Finance Leases (Capital Leases)

These structures allow the lessee to own the aircraft at the end of the term. Key aspects include:

- Higher Monthly Payments: Payments cover the full value of the jet.

- Ownership Transfer: The lessee owns the aircraft at the term’s conclusion.

- Depreciation Benefits: The lessee may claim tax benefits.

✅ Equity Release (Against Jets)

Some high-net-worth individuals and corporations use their aircraft as collateral for jet equity release.

- Loan Structure: Lenders assess the aircraft’s value and provide a percentage as a loan.

- Flexible Use of Funds: Borrowers can use the funds for investments or business expansion.

- Shorter Loan Terms: Typically 1–5 years.

✅ Bridge Loans

Bridge loans are a form of short-term private jet financing, typically used to purchase an aircraft while long-term funding is being arranged

- High-Interest Rates: Reflect the temporary nature of the loan.

- Quick Approval: Lenders assess collateral and approve funds rapidly.

✅ Fractional Ownership

For those who do not need full ownership, fractional aircraft ownership allows co-ownership of an aircraft.

- Lower Capital Outlay: Costs are divided among multiple owners.

- Managed Operations: The management company handles maintenance, pilots, and scheduling.

- Exit Strategy: Aircraft owners can sell their share or upgrade.

✅ Jet Card and Membership

Some financial institutions offer private jet financing for prepaid flight hours through jet cards, providing flexibility without ownership.

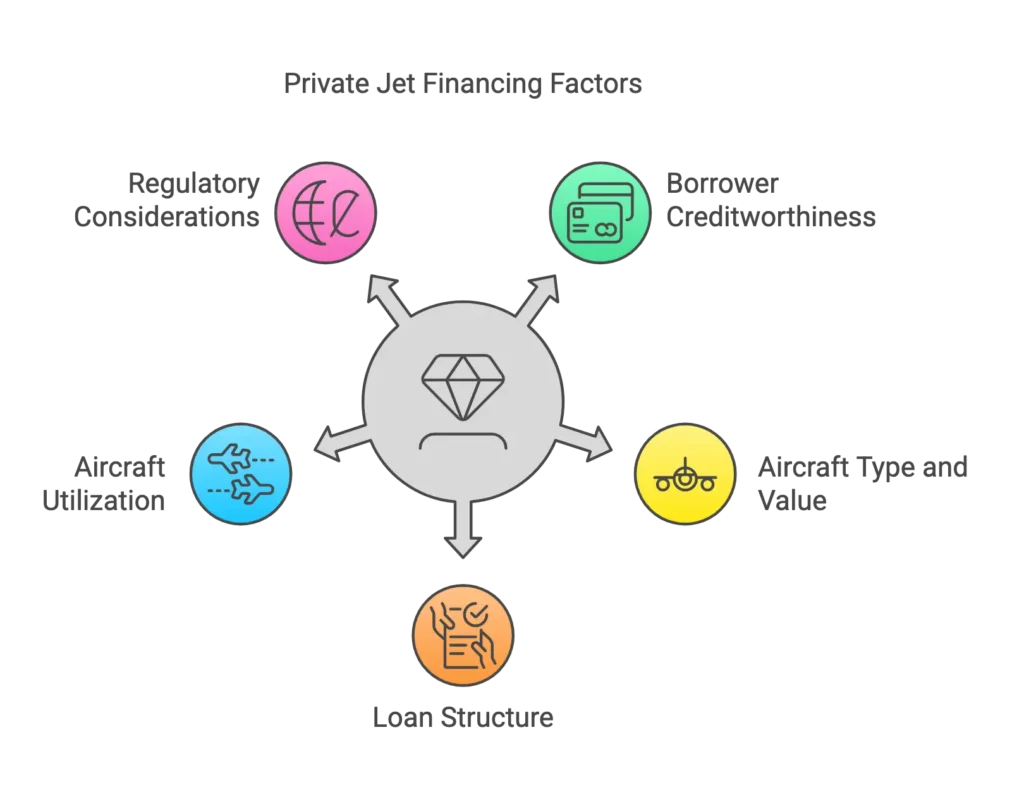

Factors Lenders Consider in Private Jet Financing

✅ Creditworthiness of the Borrower

Lenders evaluate the borrower’s financial strength, including:

- Net Worth and Liquidity: High-net-worth individuals and corporations with strong financials have better terms.

- Debt-to-Income Ratio: Determines the ability to service the loan.

- Credit Score and History: Strong credit increases approval chances.

✅ Aircraft Type and Value

The aircraft’s make, model, and market demand affect the terms. Newer jets from reputable manufacturers (e.g., Gulfstream, Bombardier, Dassault) have better resale value, making them more attractive for lenders.

✅ Loan Structure and Repayment Terms

Lenders assess repayment ability based on cash flow and business earnings for corporate buyers. Longer repayment terms reduce monthly obligations but increase total interest paid.

✅ Aircraft Utilization

A jet used frequently for corporate travel may have different terms than one used sporadically for personal use. Charter revenue potential can also influence loan terms.

✅ Regulatory and Tax Considerations

Tax benefits vary by jurisdiction. For example, the U.S. allows Section 179 depreciation for aircraft purchases, while some EU countries impose luxury taxes on business jets

Costs Associated with Executive Jets

Beyond payments for loan or rental agreements, buyers must consider:

- Maintenance and Repairs: Estimated at 3–5% of the aircraft’s value annually.

- Crew Salaries: Pilots, co-pilots, and maintenance staff costs.

- Insurance: Comprehensive coverage for liability and damage.

- Hangar and Storage Fees: Vary based on location.

Alternative Lending Options

Some buyers explore alternative funding, including:

- Crypto or Securities-Based Loans: Certain lenders accept cryptocurrency or securities as collateral.

- Family Office or Private Investors: High-net-worth individuals may finance jets through private agreements.

- Structured Solutions: Custom loan packages based on the borrower’s portfolio of assets.

Case Studies: Private Jet Financing in Action

✅ Case Study 1: Corporate Acquisition

A Fortune 500 company secured a $40M loan for a new GulfStream G650, opting for a finance lease to minimise upfront costs while leveraging depreciation deductions over a 10-year period.

✅ Case Study 2: HNW Individual Purchase

A high-net-worth individual obtained a securities-backed loan to purchase a Bombardier Global 7500, leveraging their stock portfolio without selling assets.

✅ Case Study 3: Charter Fleet Expansion

A charter company used an asset-based loan to acquire a fleet of mid-size jets, increasing revenue through fractional ownership sales.

Next Steps

✈️ Looking to fund your executive jet? Get expert guidance on the best funding options tailored to your needs. Contact Forbes Le Brock today and take off with confidence! 🚀

Serving clients across UK, Europe & Asia-Pacific

Conclusion

Financing options for VIP jets and other illiquid assets range from traditional loans to asset-backed structures. The best approach—along with selecting the right broker or wealth management partner—depends on financial goals, usage, and tax considerations. As demand for business aviation grows, innovative funding solutions continue to offer greater flexibility for buyers.

References

- NBAA (National Business Aviation Association), “Aircraft Ownership and Financing Guide.”

- Aircraft Owners and Pilots Association (AOPA), “Understanding Aircraft Loans and Leasing,” 2023.

- Bombardier Aviation, “Private Jet Market Insights,” 2024.

🧠 No time to read? Listen to the Deep Dive 🎧 Catch it now!