Illiquid vs Liquid Assets: Why Strategic Lenders Are Betting on “Slow” Collateral in 2025

Introduction: The Rebalancing of Collateral

Banks hate anything that can’t be liquidated in a panic. Private lenders love it, because panic is where they get paid.

For decades, liquidity ruled the world of luxury asset lending. A liquid asset that could be sold instantly, cash without significantly impacting its market value i.e. securities, treasury bills, were favoured as collateral because they posed little risk in a crisis. But 2025 marks a major inflection point: the rise of illiquid vs liquid assets lending.

In a world of tightening credit and diversified wealth, private lenders, family offices, and alternative credit funds are leaning into illiquid holdings, real estate, private equity, art, aircraft, and more, as collateral of choice.

This article breaks down why the lending world is warming up to slow-moving assets, how the structures work, and what this means for investors, borrowers, and the new generation of lenders.

Illiquid vs Liquid Assets – What’s The Difference?

What Are Illiquid Assets?

Illiquid assets, also known as non-liquid assets, take longer to sell and often require significant valuation effort or negotiation. Examples include:

- Real estate (commercial and residential)

- Private equity and venture capital holdings

- Art, antiques, and collectibles

- Luxury assets such as luxury yachts, classic cars and private jets

- Intellectual property (IP), patents, and trademarks

- Private company stock (pre-IPO shares)

These assets often lack transparent pricing, involve fewer market participants, and can be expensive to sell due to legal, brokerage, or appraisal costs.

What is a Liquid Asset?

A liquid asset can be easily and quickly converted into cash without significantly impacting their market value. They include:

- Cash and cash equivalents (checking and savings accounts)

- Publicly traded stocks and bonds

- Money market accounts and mutual funds

- Treasury bills and ETFs

These assets are characterised by high marketability, transparent pricing, and minimal transaction costs.

Why HNWIs Hold Illiquid Assets?

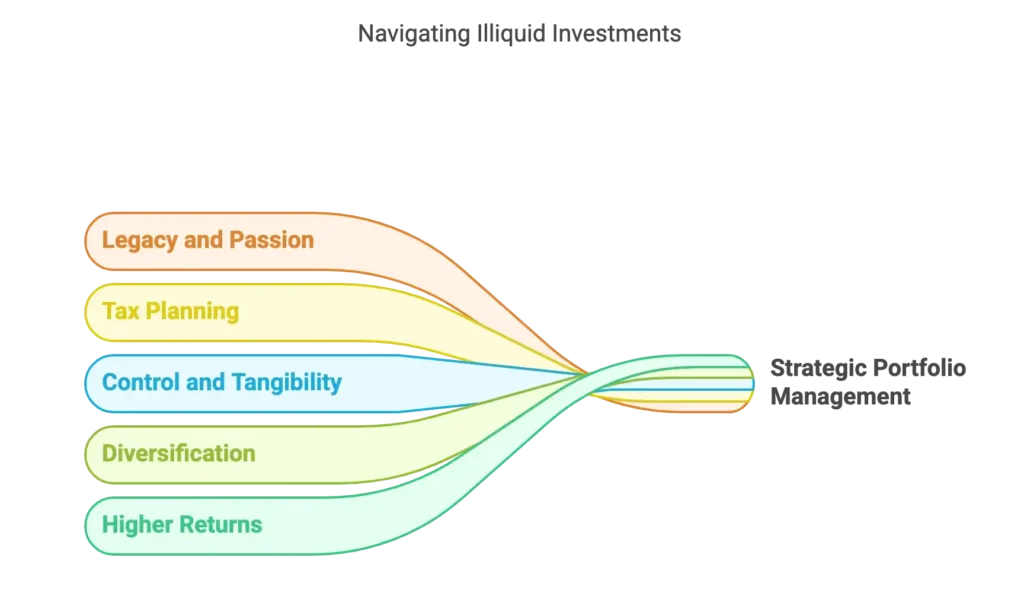

Illiquid assets reflect long-term thinking, not short-term needs

It’s no coincidence that sophisticated investors and UHNWIs often have portfolios loaded with non-liquid assets. Reasons include:

- Higher returns: Illiquidity premiums boost long-term yield.

- Diversification: Many illiquid assets are uncorrelated with stock markets.

- Control and tangibility: You can influence a business or touch a Picasso, you can’t do that with a mutual fund.

- Tax planning: Strategic holds defer gains and enhance estate planning.

- Legacy and passion: Art, yachts, classic cars and real estate aren’t just investments, they’re identity.

But here’s the catch: when these investors need liquidity, for acquisitions, tax bills, or portfolio rebalancing, they don’t want to sell. That’s where structured lending against illiquid assets becomes critical.

Why Lenders are Embracing Illiquid vs Liquid Assets in 2025

Private lenders are stepping in where banks won’t. Here’s why:

1. Scarcity Equals Security:

Unique assets (like blue-chip art, jets, classic cars or trophy properties) are harder to price, but they don’t move with the market. This provides insulation against volatility. When properly appraised and insured, they represent reliable, differentiated collateral.

2. Surging Demand for Flexible Liquidity:

Borrowers want to unlock liquidity without selling. Lenders that can monetize illiquid holdings, without forcing a sale, are gaining market share.

3. Evolution of Structured Finance:

Modern lending structures now protect lenders without requiring asset sales:

- SPVs (Special Purpose Vehicles) hold the asset, isolating legal risk.

- Trust and Custodian Agreements secure lender rights and simplify enforcement.

- Control Agreements restrict borrower actions, enforce covenants, and define recovery conditions.

4. Search for Yield and Market Differentiation

With yields compressed across public credit markets, lenders are drawn to illiquid asset classes. Higher complexity = higher reward, especially for:

- Private credit funds

- Family offices

- Alternative asset managers

How Lending Against Illiquid Assets Works

Type of Loans Secured on Illiquid Assets

- Asset-Based Loans: Secured directly by an illiquid asset

- Bridge Loans: Short-term facilities while waiting for liquidity events

- Lines of Credit: Flexible drawdowns backed by pledged collateral

Loan-to-Value (LTV) Ratios

Conservatism is key:

- Fine Art Finance: 30–50%

- Jets and Yachts: 50–70%

- Real Estate: 60–75%

- Private Equity: ~40% or less

How Lenders Protect Themselves

- Legal title transfer or registered liens

- Custody agreements (e.g., storing art in specialist facilities)

- Mandatory insurance and valuation covenants

- Performance covenants to maintain asset condition (for aircraft/yachts)

Valuation and Liquidity Risk

- Valuation risk: The estimated value may not match market reality.

- Liquidity risk: The time it takes to sell can vary widely, especially in downturns.

Sophisticated lenders address this with conservative LTVs, third-party appraisals, and optional revaluations over time.

Who’s Lending Against Illiquid Assets?

The field is niche, but growing. Key players include:

- Private Banks: Offering tailored solutions for UHNWIs

- Specialty Finance Firms: Focused on asset classes like aviation, art, and marine

- Family Offices: Lending to peers for strategic capital deployment

- Private Credit Funds: Seeking risk-adjusted returns in asset-rich environments

These lenders are agile, creative, and experienced in handling complex collateral.

Case Studies: Utilising Illiquid Assets

1. Jet-Backed Loan for Working Capital

A tech founder needs $5M. Rather than sell private equity, he pledges his Gulfstream G650. The aircraft is held in trust, with strict covenants. The lender advances funds at a 50% LTV.

2. Fine Art Pledged for Real Estate Acquisition

A $25M post-war art collection secures a $10M loan. The artwork remains in secure storage, with a custodial agreement in place. The borrower avoids a taxable event and retains collection integrity.

3. Superyacht Used to Refinance High-Cost Debt

A 60m yacht secures a $12M refinancing deal. After valuation and inspection, the loan closes at a 55% LTV with a term of 24 months, interest-only.

Illiquid Assets: Risks and Considerations

For Lenders:

- Valuation risk: Complex or opaque asset classes

- Legal risk: International or jurisdictional challenges

- Fraud risk: Asset misrepresentation or unclear ownership

- Enforcement complexity: Seizing, storing, or liquidating niche assets

For Borrowers:

- Higher costs: Interest rates and legal fees are usually higher

- Lower LTVs: Compared to liquid securities-based lending

- Potential loss: Default can mean losing a unique or sentimental asset

Due diligence is everything, for both parties.

FAQs: Understanding Illiquid vs Liquid Assets in Lending

Q: What’s the difference illiquid vs liquid assets?

Illiquid assets: like fine art, private equity, classic cars or real estate, often take time to sell and may require discounts to find buyers, especially in soft markets.

Liquid assets: can be converted to cash quickly and with minimal loss in value. These typically include stocks, bonds, or savings accounts.

Q1: Why are some assets considered liquid while others are not?

Assets are considered liquid if they trade in deep markets with active buyers and sellers. Liquidity comes from speed of sale, price transparency, and predictable conversion to cash. Illiquid assets lack these, they may take several months or longer to sell, require expert valuation, or have no obvious marketplace.

Q2: Can real estate or private jets be used as collateral if they’re hard to sell?

Yes, if properly appraised and insured, even assets that are difficult to sell can support lending. Lenders assess liquidity risk and adjust loan-to-value ratios accordingly. Structures like SPVs and custodial control reduce exposure while unlocking capital for the borrower.

Q3: Are illiquid investments riskier to lenders?

They tend to carry a higher degree of risk, not because of poor quality, but because it may take longer to sell the asset if needed. This introduces liquidity risk, which lenders mitigate with conservative LTVs and stronger due diligence.

Q4: What are examples of highly liquid assets?

Examples include cash, marketable securities, money market funds, and treasury bills. These are commonly held “on hand” to meet obligations or fund short-term opportunities. They’re also ideal for emergency funds due to their low volatility.

Q5: Are mutual funds and ETFs considered liquid?

In most cases, yes. Exchange-traded funds and mutual funds that invest in public equities can generally be sold within a day. However, some funds with redemption restrictions or exposure to private markets may be less liquid than they appear.

Q6: Why might someone want to avoid selling a non-liquid asset?

Selling an illiquid asset may trigger capital gains taxes, disrupt long-term strategy, or force a loss in value. For HNWIs, it’s often smarter to borrow against the asset, preserving ownership while accessing liquidity.

Q6: Is there a downside to using liquid assets as collateral?

While liquid assets are easy to value and sell, they also tend to move with market volatility. A sudden drop in stock prices, for instance, can reduce collateral value and trigger margin calls, a risk less common with rare or stable illiquid assets.

Conclusion: 2025 is the Year of Illiquid Lending

Liquidity used to be king and a liquid asset always won the day. But in today’s market, patient capital wins.

For borrowers, lending against illiquid vs liquid assets means accessing cash without selling prized holdings. For lenders, it’s a way to generate yield, security, and differentiation in a crowded market.

Slow is no longer a weakness, it’s a signal of strength.

Serving clients across UK, Europe & Asia-Pacific, Forbes Le Brock specialises in alternative investment lending strategies that can unlock the value of unique assets without forced liquidation.

Contact us today to explore what your fine art, private aircraft, classic cars real estate, could do, without compromising your portfolio.

🧠 Want to hear others’ take on illiquid vs liquid assets lending? Listen to this audio review for the highlights. 🎙️