How Luxury Asset Loans Beat 2025 Tariff Battles: Leveraging Jets, Yachts, and Fine Art

Introduction: The Return of the Tariff War

The global economic landscape is increasingly defined by friction. Trade tensions, once simmering beneath the surface, have erupted into overt tariff battles and complex regulatory regimes. From the ongoing US-China trade dispute to evolving EU-US relations and targeted sanctions, the free movement of capital and high-value goods faces significant headwinds. For high net worth individuals (HNWIs), family offices, and global investors, this new era of protectionism presents unique challenges.

Assets held across borders, plans for acquiring significant international property like private jets or superyachts, and even the management of globally diversified collections of fine art are now subject to a complex web of duties, taxes, and bureaucratic hurdles.

Moving substantial capital can trigger scrutiny, while importing these high-value luxury assets can incur prohibitive costs, delaying acquisitions or locking up liquidity. In this environment, traditional financial pathways often prove slow, inflexible, or simply inadequate.

However, a sophisticated financial instrument offers a powerful, discreet alternative specifically tailored for these high-value categories: luxury asset loans secured by private jets, luxury yachts, and fine art.

For those navigating the complexities of international tariffs and capital constraints, understanding how to leverage these existing major assets can provide a critical strategic advantage, unlocking liquidity and enabling decisive action while others remain entangled in red tape. This isn’t merely a potential workaround; it’s a strategic financial tool for complex times, focused on the assets that matter most in global mobility and high-value collecting.

Understanding Luxury Asset Loans: A Strategic Liquidity Tool for Major Assets

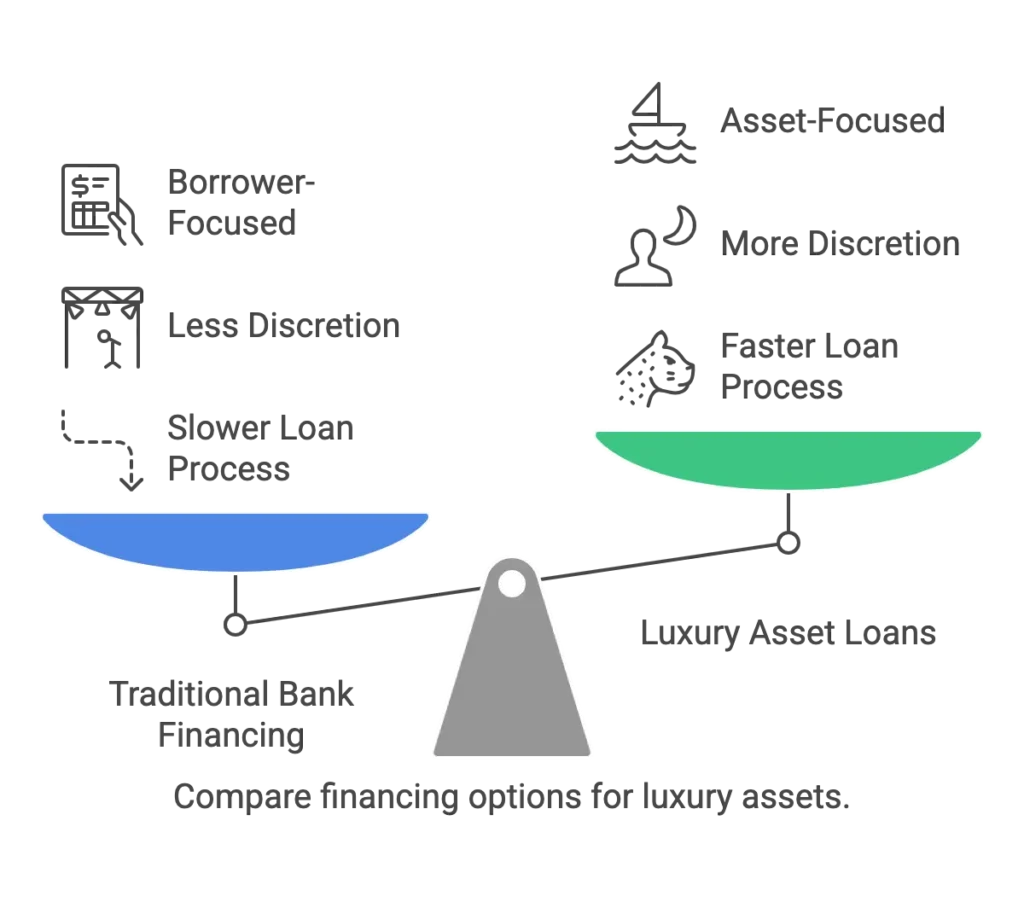

At its core, a luxury asset loan is a form of asset based lending. Instead of relying primarily on credit scores or extensive financial disclosures (often involving minimal credit checks), this type of finance is secured by the inherent value of specific, high-end tangible assets: primarily superyachts moored in global hotspots, private jets based internationally, classic cars and collections of investment-grade fine art.

The fundamental principle is straightforward: the lender provides capital based on an appraised value of the luxury asset, which serves as finance collateral. Crucially, the borrower retains ownership of the asset. There is no sale, meaning no capital gains tax implications (check with your tax advisor) and, significantly in the context of global tariffs, often no requirement to physically move the asset across borders to secure the finance.

Key characteristics of luxury or illiquid asset loans focused on jets, yachts, and art include:

- Asset-Focused: The finance amount is primarily determined by the valuation and marketability of the specific private jet, yacht, or fine art piece(s) used as collateral, not the borrower’s broader financial picture.

- Discretion and Speed: The process is typically faster (offer fast) and more discreet than traditional bank financing, often conducted through private offices with a seamless experience. Specialist lenders (premier collateral lender, collateral lender) understand the unique nature of these major assets and their owners’ need for privacy.

- Liquidity Without Selling: Owners can access significant capital tied up in their valuable jets, yachts, or art (assets as collateral) without being forced to sell them, preserving these significant holdings.

- Flexibility: Luxury asset loan products can often be structured as short-term finance or potentially a line of credit, offering adaptable financing options tailored to specific needs, such as bridging finance for another major acquisition, opportunity capital, or managing temporary cash flow issues related to asset maintenance or other ventures.

Leading providers in this space, often privately-held firms specializing in non-bank loans, are experts in lending against luxury assets such as jets, yachts, and art. They understand the nuances of using high-value assets as collateral at this scale

The Hidden Advantage: Using Luxury Asset Finance to Navigate Tariff Minefields

Luxury asset loans offer a quiet strategic edge, especially for jets, yachts, and fine art. Because these loans are secured by the asset in situ, where it’s based, moored, or stored, they can sidestep tariffs, import duties, and cross-border capital controls that usually come into play when moving high-value assets or repatriating sale proceeds.

Consider these scenarios:

Acquisition Finance Without Import Headaches: Need capital in the US, but your wealth is tied up in a European freeport art collection? Selling the art might trigger export taxes and compliance red tape. Instead, you use the art as collateral, without moving it—to secure a USD loan. The art stays put, and you sidestep any customs or capital flow restrictions. The same approach works for yachts in the Med financing Asian deals or Middle Eastern jets backing investments in Europe.

Unlocking Liquidity Across Borders: A jet based in the Gulf. A deal in the EU. Traditional financing or selling the aircraft could involve weeks of paperwork and regulatory friction. A lender with global reach can issue a Euro loan secured against the jet, no relocation, no delays. It’s a fast, compliant way to unlock liquidity from mobile assets without disrupting their operational footprint.

Estate Planning & Portfolio Rebalancing: Restructuring a trust or rebalancing an art-heavy portfolio across jurisdictions? Physical transfers can trigger taxes, tariffs, or a deemed disposition. A luxury asset loan lets you extract liquidity from the assets without selling or moving them, an elegant solution for trustees, beneficiaries, or advisors managing complex, multi-jurisdictional wealth structures.

Bottom line: Luxury asset loans unlock value from high-end assets—jets, yachts, and art—without tripping over the regulatory wires that surround cross-border movement. You separate where the value sits from where the capital flows.

Luxury Asset Loans in Action: Real-World Examples with Jets, Yachts, and Art

While discretion is key, here are illustrative examples showing how HNWIs are leveraging luxury asset finance for liquidity—without triggering unnecessary tax or regulatory headaches.

1. Jet in France, Deal in the UK: An entrepreneur owns a private jet based in France and spots a time-sensitive investment in the UK. Rather than sell the aircraft or pursue slow-moving cross-border loans, they secure a GBP luxury asset loan against the jet. The aircraft stays in France, available for use, no export or import tariffs apply.

2. Yacht in Monaco, USD Needed: An investor with a luxury superyacht moored in Monaco needs USD for a US-based deal. Instead of navigating complex temporary import rules, they obtain a luxury asset loan against the yacht. The vessel doesn’t move, no tariffs, no red tape, just fast access to capital via a specialist maritime lender.

3. Swiss Freeport Art, Global Diversification: A family office holds valuable art in a Swiss freeport but wants to diversify into private equity. Rather than sell and trigger tax events, they use the collection as collateral. The art stays in Switzerland, and they unlock liquidity without compromising long-term holdings.

Takeaway: Whether it’s a jet, yacht, or art collection, luxury asset loans offer discreet, strategic liquidity, without crossing borders or triggering costly duties.

Why Are More People Borrowing Against Jets, Yachts, and Art?

Luxury asset loans or illiquid asset loans, where borrowers use assets like private jets, superyachts, or valuable art as collateral, are on the rise. It’s not just about avoiding tariffs. There are several reasons high-net-worth individuals (and the institutions that serve them) are increasingly exploring this type of financing:

Traditional Lenders Don’t Always Fit: Big banks often don’t want to deal with unique assets like art or boats, especially if you’re not using the funds to buy something new. They’re cautious, slow-moving, and focused on standard credit criteria. That’s where specialist lenders step in, offering more flexible solutions tailored to these types of assets.

These Assets Hold Their Value: Jets, yachts, classic cars and blue-chip art often hold significant resale value. When markets are steady, they’re considered strong collateral—making it possible to unlock serious capital without selling the asset outright.

Speed, Privacy, and Flexibility Matter: Wealthy individuals often need fast, discreet funding, whether for an investment opportunity or a short-term liquidity need. Luxury asset loans can offer quicker turnaround times, fewer personal questions, and less red tape than traditional loans.

A Complex World Requires New Tools: With geopolitical uncertainty, shifting regulations, and unpredictable currencies, some clients are choosing to keep their assets close and use them as leverage instead. Financing against tangible assets offers a degree of control and insulation that’s hard to find elsewhere.

The Lenders Know Their Stuff Now: This niche lending space has matured. Today’s providers understand how to value and secure these assets properly, whether it’s through in-person inspections, secure storage, or liaising with registries and insurers. Their job is to make things easier, not more complicated.

What to Keep in Mind Before You Borrow

If you’re considering a loan against a jet, luxury yacht, classic car or fine art piece, here are a few things to think about:

- The Asset Matters: Not every jet, yacht, car or painting qualifies. Lenders look closely at factors like age, condition, market demand, and provenance. For aircraft, maintenance records and flight hours are key; for art, it’s often about the artist’s reputation and market interest.

- Valuation Takes Time: These aren’t everyday assets. Expert appraisals, by aviation consultants, marine surveyors, or art specialists, are part of the process. A good valuation sets the stage for the maximum loan amount.

- You Won’t Get 100% of the Value: Expect loan-to-value ratios (LTVs) between 40% and 80%, depending on the asset and market conditions.

- Location Can Matter: Whether it’s a jet’s registration, a yacht’s flag, or a painting’s storage location, logistics and jurisdiction can affect the luxury asset loans process. Lenders need confidence that they can secure their collateral properly.

- Choose the Right Lender: Not all lenders are equal. It’s worth working with firms that specialise in luxury assets, know the legal landscape, and are transparent about costs and processes.

A Smarter Way to Stay Liquid

When traditional finance slows things down or adds unnecessary friction, luxury asset loans offer an alternative. This type of finance lets you tap into the value of your existing assets and luxury goods, without having to sell, move them across borders, or wait on bank approvals.

In a world that’s anything but predictable, this type of finance provides a powerful, discreet, and flexible way to stay agile, whether you’re seizing a new opportunity or managing short-term liquidity. It’s not just about access to capital; it’s about having more control over how and when you use it.

Next Steps

If you, or a client, hold a private jet, luxury superyacht, classic car or fine art collection and are looking to unlock capital without the complications of a sale, tax events, or cross-border friction, then contact us today to discuss luxury asset loans structures tailored to today’s global environment. Currently serving clients across UK, Europe & Asia-Pacific

Want a deeper dive into how luxury asset loans beat the 2025 tariff battles? Listen to the Deep Dive HERE