Luxury Yacht Financing – What You Need To Know About Financing a Yacht in 2025

For high-net-worth individuals (HNWIs) and C-suite executives, financing a yacht represents a significant investment, often symbolising both a personal achievement and a strategic asset. However, the substantial capital outlay required for such a purchase necessitates careful financial planning. This comprehensive guide explores the intricacies of yacht financing, providing insights and strategies tailored to a sophisticated financial audience, helping them navigate the complexities and optimize their investment. We’ll cover everything from traditional boat loans to more specialized financing structures, empowering you to make informed decisions that align with your overall financial strategy.

🧠 Want to hear others’ take on the blog post? Listen to this audio review for the highlights. 🎙️ Listen here!

Understanding the Landscape of Yacht Financing

The yacht lending market is a specialised niche within the broader world of luxury asset lending. Unlike auto loans or even home mortgages, financing a yacht involves larger sums, more complex due diligence, and a greater understanding of the asset’s unique characteristics.

Yacht Market Growth: The global superyacht market is projected to grow from $9.06 billion in 2024 to $9.48 billion in 2025, reflecting a compound annual growth rate (CAGR) of 4.7%.

Lenders in this space are not just evaluating the borrower’s creditworthiness; they are also assessing the yacht’s value, its potential for depreciation, and its operational costs.

Why Finance Instead of Paying Cash?

Financing a yacht allows buyers to preserve liquidity for other investments or unforeseen expenses. Choosing to fund a superyacht instead of paying cash can be a strategic move, especially given current market trends. In 2025, the new luxury vessel market is expected to see continued price increases, while the used boat market may experience slight price reductions due to increased inventory availability. These fluctuations highlight the importance of securing favorable loan terms to mitigate potential pricing volatility.

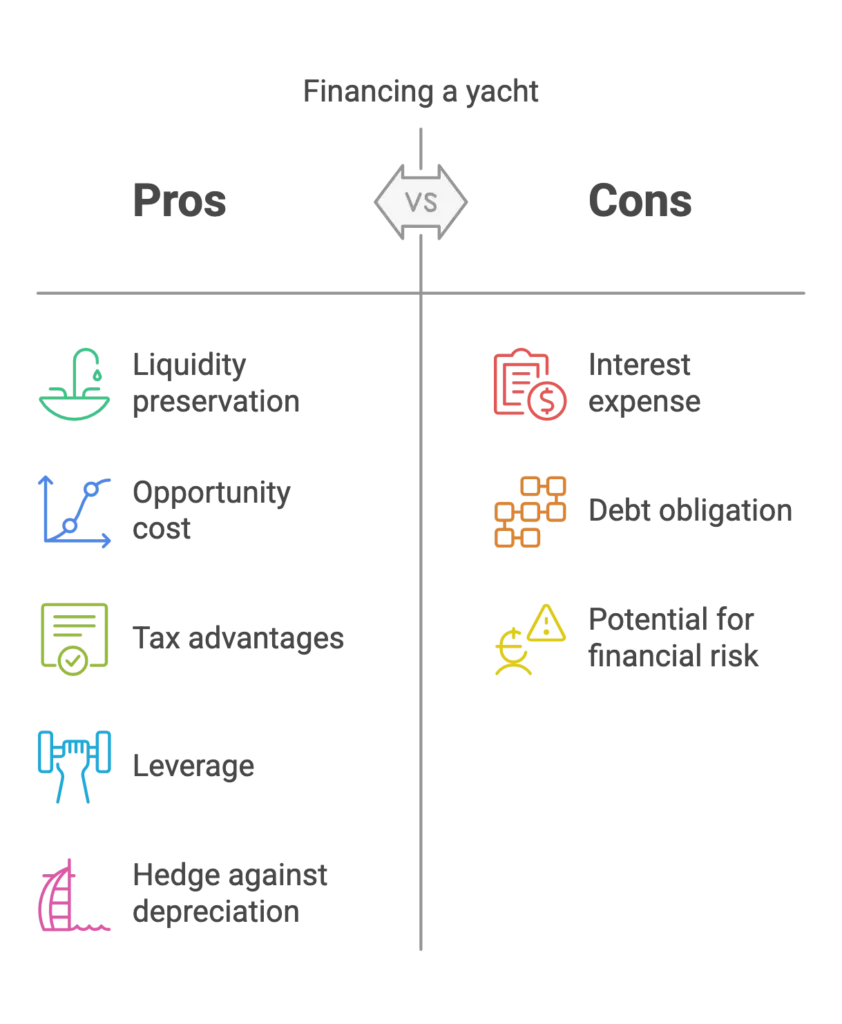

While HNWIs may have the liquid assets to purchase a vessel outright, financing a yacht often presents a more strategically advantageous approach. Several key reasons support this:

- Liquidity Preservation: Tying up a significant portion of capital in a single asset can limit investment opportunities and reduce financial flexibility. Borrowing allows you to retain liquidity for other ventures, potentially generating higher returns than the cost of the loan.

- Opportunity Cost: The capital preserved by lending can be deployed in other investments, such as securities, real estate, or business ventures, potentially yielding higher returns than the interest expense on the loan.

- Tax Advantages: In certain jurisdictions, and under specific conditions, the interest paid on financing a yacht may be tax-deductible. If the vessel qualifies as a “second home” (possessing a berth, head, and galley), the interest on the loan can potentially be deducted, similar to a traditional home mortgage. The IRS currently allows deductions on interest for up to $750,000 of mortgage debt for combined first and second homes. If it is used for business purposes, further deductions may be available, such as depreciation.

- Leverage: Borrowing allows you to leverage your existing assets to acquire a larger or more luxurious model than might be possible with a cash purchase.

- Hedging against depreciation: Luxury vessels, like many luxury assets, can depreciate. Borrowing a portion of the purchase allows to preserve capital in other appreciating assets.

Exploring Your Yacht Financing Options

Several funding options are available, each with its own advantages and disadvantages. Understanding these options is crucial for selecting the best fit for your individual circumstances.

The superyacht segment is experiencing significant growth, with the market projected to reach $21.60 billion by 2025 and $45.16 billion by 2032. This expansion highlights the increasing demand for high-value marine craft financing solutions, making structured lending options more essential than ever.

1. Traditional Yacht Loans (Marine Mortgages)

- Similar to a home mortgage, this type of loan (often called a marine mortgage) is a secured loan where the boat itself serves as collateral. These loans typically offer:

- Fixed or Variable Interest Rates: Fixed-rate loans provide predictable monthly payments, while variable-rate loans may offer lower initial rates but are subject to market fluctuations. As of 2025, top lenders are offering boat loans with rates starting at 6.49%, depending on the borrower’s credit profile and the terms. These competitive rates enhance the appeal of borrowing over outright purchases, especially for those seeking liquidity flexibility.

- Loan Terms: The terms typically range from 10 to 20 years, although longer terms may be available for larger, more expensive models.

- Down Payment: Typically a down payment of 10% to 20% of the purchase price, is required, though this can vary based on the borrower’s creditworthiness and the value of the boat. Larger down payments can often secure a better annual percentage rate.

- Credit Score Requirements: Most financiers offering maritime loans will require a minimum credit score, and the best annual rates and terms are generally offered with a FICO of 700 and above, with some considering as low as 600.

- Debt to Income Ratio (DTI): They will look at the buyers’ DTI, usually wanting to see a DTI of 35% or less.

Benefits:

- Predictable payments (with fixed-rate loans).

- Potentially lower rates compared to unsecured loans.

- Longer repayment terms, reducing monthly payments.

Drawbacks:

- The vessel is used as collateral, meaning the finance company can repossess it if you default on the loan.

- Requires a down payment.

- Can involve a more extensive application and approval process.

2. Marine Specialized Lenders

These specialize in the marine industry and understand the unique aspects of financing a yacht.

Benefits:

- Expertise in luxury vessel valuation and credit approval.

- Potentially more flexible terms.

- Faster approval process compared to traditional banks.

- Willingness to consider older or unique type of watercraft that traditional banks might decline.

- Can offer specialized guidance.

Drawbacks:

- May have slightly higher annual rates compared to traditional banks.

- May require a larger down payment for certain types of craft.

3. Secured Loans Against Other Assets

HNWIs often possess substantial assets, such as investment portfolios, real estate holdings, or even art collections. These assets can be used as collateral for a secured loan, providing the funds to purchase the yacht.

Benefits:

- Potentially lower rates than unsecured loans.

- May allow for larger loan amounts.

- Avoids using the yacht as direct collateral.

Drawbacks:

- Requires pledging valuable assets as collateral.

- The financier can seize the pledged assets if you default on the loan.

4. Unsecured Loans

While less common for large purchases, unsecured loans are an option, particularly for smaller vessels or for borrowers with exceptionally strong credit profiles.

Benefits:

- No collateral required.

- Faster approval process.

Drawbacks:

- Significantly higher rates.

- Smaller loan amounts.

- Requires an excellent credit history.

5. Leasing and Charter Management Programs

- Leasing: Maritime leasing provides an alternative to outright ownership, offering lower upfront costs and fixed monthly payments over a set period.

- Charter Management Programs: These programs allow you to offset some of the ownership costs by chartering the vessel when you’re not using it. The charter income can help cover loan payments, maintenance, and other expenses.

Benefits:

- Lower initial investment.

- Potential to generate income through chartering.

- Reduced maintenance responsibilities (in some charter programs).

Drawbacks:

- You don’t own the asset outright (in leasing).

- Limited personal use (in charter programs).

- May not be the most cost-effective option in the long run.

6. Balloon Payment Structures

Some financiers offer loans with a balloon payment, where the final payment at the end of the term of the loan, is significantly larger than the previous payments. This structure can lower monthly payments during the term but requires careful planning to ensure the balloon payment can be met.

7. Refinancing

If lending rates decrease or your financial situation improves, refinancing your yacht loan can be a beneficial strategy. Refinancing can lead to lower monthly payments, a shorter term, or both.

Application Process When Financing a Yacht: What to Expect

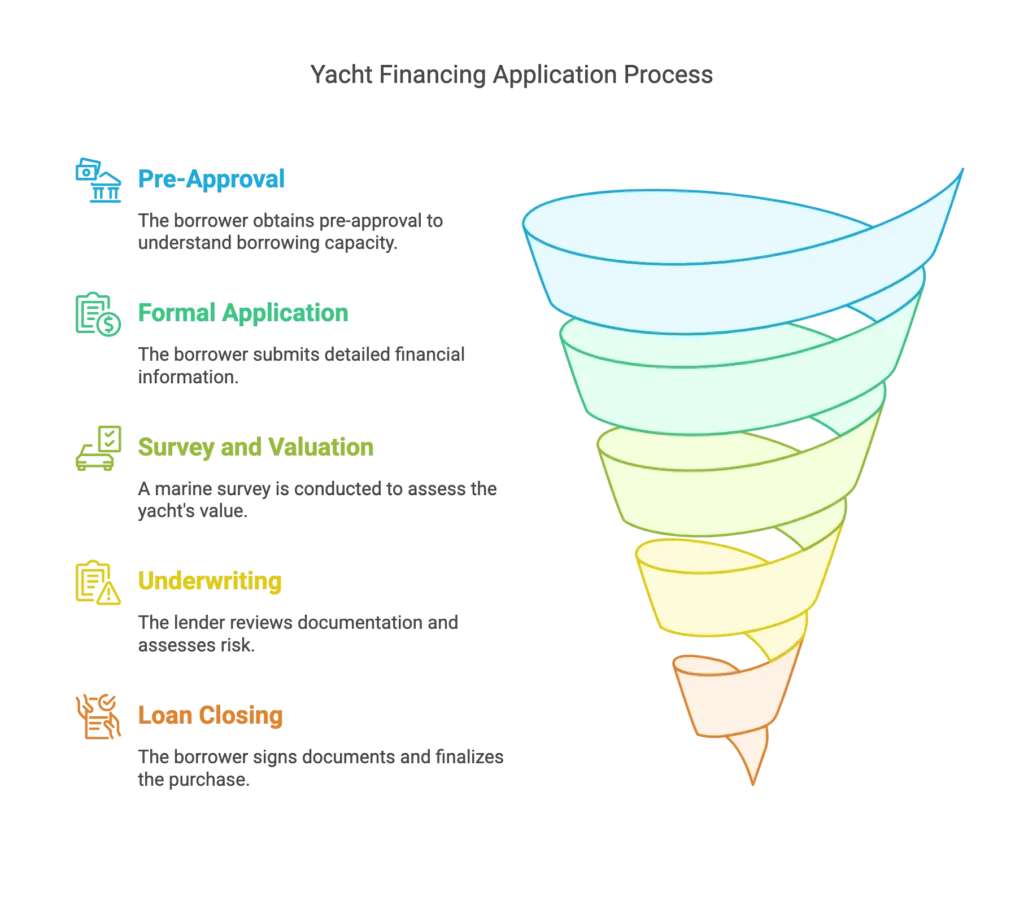

The yacht loan application process is generally more rigorous than for smaller loans. An internal appraiser will conduct thorough due diligence, assessing both the borrower’s financial profile and the yacht itself.

Key Steps:

- Pre-Approval: It’s highly recommended to get pre-approved for a loan before seriously shopping. Pre-approval gives you a clear understanding of your borrowing capacity and strengthens your negotiating position with sellers.

- Application: The formal application will require detailed financial information, including:

- Personal financial statements.

- Tax returns (typically for the past two to three years).

- Proof of income and assets.

- Credit history.

- Details about the model (brand, year, purchase price).

- Survey and Valuation: For used boats, and often for new builds, finaciers will require a marine survey to assess the vessel’s condition and value. This is a crucial step to ensure the craft is worth the loan amount.

- Underwriting: The underwriting team will review all the submitted documentation and assess the risk of the loan.

- Loan Closing: Once approved, the loan closing process involves signing the loan documents and finalizing the purchase.

Key Considerations for HNWIs and Decision-Makers

- Loan-to-Value (LTV) Ratio: This is the ratio of the loan amount to the yacht’s appraised value. Finance companies typically prefer LTV ratios of 80% or less, meaning you’ll need a down payment of at least 20%.

- Debt-to-Income (DTI) Ratio: Your DTI will be assessed to ensure you can comfortably afford the loan payments along with your other financial obligations.

- Liquidity Requirements: Funders want to see that you have sufficient liquid assets to cover the down payment, closing costs, and ongoing operating expenses of the yacht.

- Insurance: Comprehensive marine insurance is mandatory for yachts loans.

- Running costs: The costs of operating the yacht which include hiring a crew, are likely to cost around 10% of the yacht’s value annually. These aren’t covered, so one needs to comfortably cover them in addition to the loan repayments.

- Tax Implications: Consult with your tax advisor to understand the potential tax deductions and implications.

- Legal Advice: Seek counsel from a maritime lawyer on the best option for ownership, funding options and registration.

Case Study: Financing a Super Yacht Acquisition

A high-net-worth individual (HNWI) is interested in purchasing a 150-foot super yacht valued at $30 million. After consulting with their financial advisor, they decide to pursue their funding options, and preserve liquidity for other investment opportunities.

- Option 1: Traditional Marine Mortgage: The HNWI secures a marine mortgage with a 20% down payment ($6 million) and a 15-year term at a fixed interest rate of 7.5%. This results in monthly payments of approximately $222,457.

- Option 2: Secured Loan Against Investment Portfolio: The HNWI pledges a portion of their investment portfolio as collateral for a secured loan. They obtain a loan for $24 million at a lower interest rate of 6% due to the strong collateral. This results in lower monthly payments compared to the marine mortgage.

- Option 3: Combination Approach: The HNWI decides to combine a smaller marine mortgage with a secured loan against their investment portfolio. This allows them to minimise the down payment on the marine mortgage while still benefiting from a lower overall interest rate.

The HNWI, in consultation with their financial and legal advisors, carefully evaluates each option, considering the interest rates, terms, tax implications, and the impact on their overall financial strategy. They ultimately choose the combination approach, optimizing their liquidity and leveraging their existing assets.

Conclusion: Charting a Course to Yacht Ownership

Financing a Yacht can provide a powerful tool for HNWIs and decision-makers to acquire their dream vessel while maintaining financial flexibility and optimizing their investment strategy. By understanding the various lending options, the application process, and the key considerations involved, you can navigate the complexities of customized yacht financingwith confidence.

Actionable Insights for Decision-Makers:

- Consult with Financial Professionals: Engage your financial advisor, tax advisor, and a maritime lawyer to discuss your specific needs and develop a tailored financing strategy.

- Get Pre-Approved: Obtain pre-approval for a loan to understand your borrowing capacity and strengthen your negotiating position.

- Compare Multiple Offers: Don’t settle for the first offer you receive. Compare rates, terms, and fees from multiple lenders.

- Factor in All Costs: Consider not only the purchase price but also the ongoing operating expenses, including insurance, maintenance, crew, and dockage.

- Negotiate: Don’t be afraid to negotiate the loan terms and the purchase price.

- Understand Loan To Value: A LTV of 80% or lower is preferable.

By taking a proactive and informed approach to funding, you can transform your dream into a reality while making sound financial decisions that align with your long-term goals

Next Steps

Ready to navigate the complexities of owning a luxury yacht? Contact our team today to explore tailored funding solutions that align with your financial goals and make your dream of ownership a reality

For a detailed third-party review, listen to the discussion on YouTube.