Mezzanine Financing in Real Estate Development – A Strategic Guide

Introduction: Beyond Senior Debt and Equity

In the high-stakes world of commercial real estate, securing the right capital structure is paramount. For C-suite executives, seasoned property developers, and high-net-worth investors, the challenge often lies in the gap between what a senior lender will provide and the equity on hand. While traditional senior debt is foundational, it rarely covers the full scope of a major development project. Conversely, raising additional common equity can dilute ownership and cede strategic control.

This is precisely where mezzanine financing in real estate emerges not just as an alternative, but as a sophisticated financing tool. It provides the critical capital to bridge the funding gap, enabling ambitious acquisitions or development projects to proceed without compromising the developer’s vision. Understanding how to leverage this hybrid form of finance is essential for optimising the capital stack and maximising return on equity in today’s competitive market.

Understanding Mezzanine Finance in the Capital Stack

Mezzanine financing in real estate, also known as a mezzanine loan or mezzanine debt, is a hybrid form of capital that combines features of both debt and equity financing. Its name comes from its position in the capital stack, sandwiched between the senior debt (like a first mortgage) and the developer’s own equity contribution.

Think of the capital stack for a development project as a hierarchy of risk and repayment:

- Senior Debt: The most secure position. The senior lender is paid first in the event of a default.

- Mezzanine Debt: The middle tier. This is a form of subordinated debt, meaning mezzanine loans are subordinate to senior debt. The mezzanine lender is only repaid after the senior loan is fully satisfied.

- Preferred Equity: Sits below mezzanine debt but above common equity.

- Common Equity: The highest-risk position, held by the developer and equity investors, who are paid last but stand to gain the most from the project’s success.

Because the mezzanine lender assumes more risk than the senior lender, they are compensated with a higher interest rate and often an “equity kicker.“

The Structure Behind Mezzanine Financing in Real Estate

The unique power of a mezzanine financing in real estate lies in its flexible structure. While terms are tailored to each deal, they typically include several key components:

- Higher Interest Rate: Reflecting its subordinated position, mezzanine debt carries a higher interest rate than a senior loan. This interest can be structured as cash-pay, “Pay-In-Kind” (PIK) where interest accrues to the principal, or a combination of both.

- Equity Kicker: This is the “equity” component. Mezzanine lenders often receive warrants or an option to convert debt to an equity interest in the property or development company. This allows them to share in the project’s upside, providing a powerful incentive that aligns their interests with the borrower.

- Subordination: The defining feature of this type of finance. An Intercreditor Agreement is established, legally defining the rights and repayment priority between the senior lender and the mezzanine lender.

- Arrangement & Exit Fees: Like other business loans, origination and exit fees are standard components of the financing package.

When to Use Mezzanine Financing in Real Estate

For a property developer or real estate investor, the decision to use mezzanine financing is a strategic one, typically driven by one of the following scenarios:

- Bridging a Funding Gap: The most common use. When the total cost of a purchase or development project exceeds the sum of the senior loan and the developer’s available equity contribution.

- Maximising Leverage & Returns: It allows developers to reduce the equity requirement for a project, freeing up capital for other opportunities and potentially amplifying the final return on equity.

- Preserving Ownership and Control: It serves as a powerful alternative to bringing in additional equity investors, allowing the developer to retain a larger ownership stake and maintain control over the project’s direction.

- Funding a Time-Sensitive Acquisition: In competitive markets, speed is critical. Securing mezzanine finance can be faster than a full equity raise, providing the additional financing needed to close a deal quickly for strategic acquisitions or development projects.

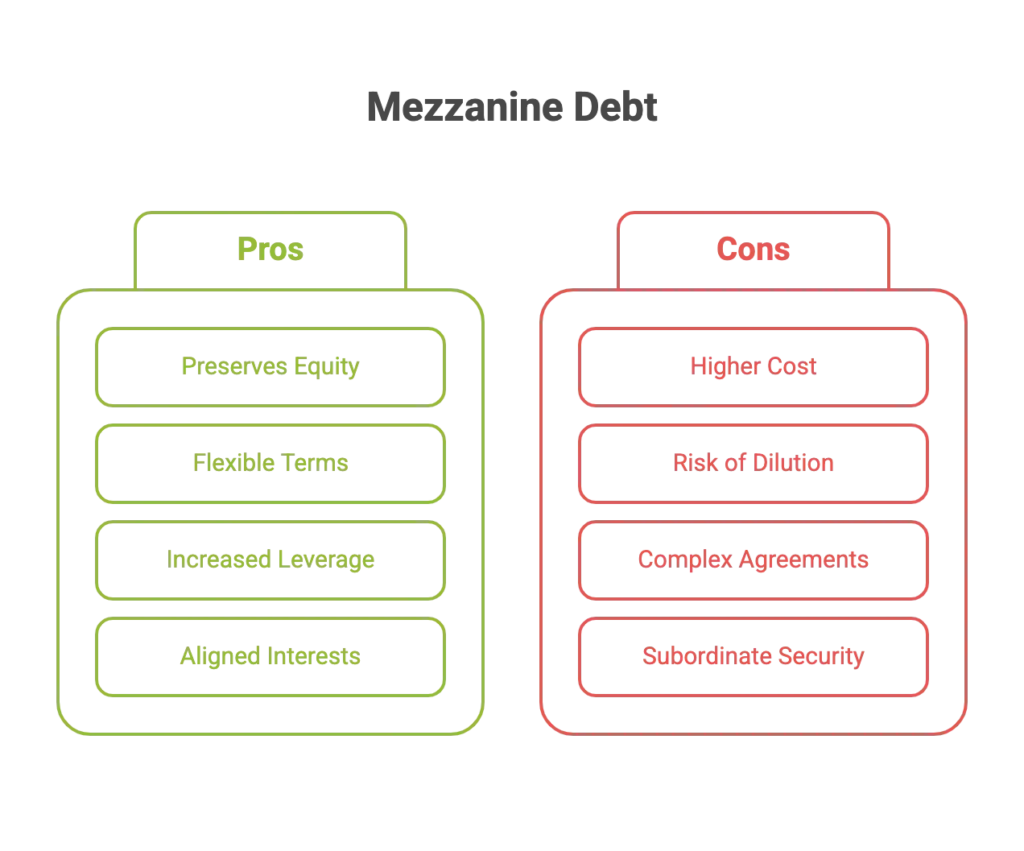

Advantages and Disadvantages of Mezzanine Debt

Like any sophisticated financial instrument, mezzanine debt offers a distinct set of benefits and risks that must be carefully weighed.

Advantages of Mezzanine Finance:

- Preserves Equity: The primary benefit is avoiding significant ownership dilution that comes with raising additional equity.

- Flexible Terms: The financing structure can be highly customised to align with the project’s specific cash flow projections and timeline.

- Increased Leverage: Allows developers to take on larger, more profitable real estate project opportunities than their equity alone would permit.

- Aligned Interests: The equity kicker component aligns the mezzanine lender’s goals with the borrower’s, as both benefit from the project’s ultimate success.

Disadvantages of Mezzanine Finance:

- Higher Cost of Capital: The higher interest rates and fees make it more expensive than senior debt.

- Risk of Dilution: If the project underperforms and the lender exercises their warrants, the developer’s equity stake will be diluted.

- Complex Agreements: The legal documentation, particularly the Intercreditor Agreement, is complex and requires expert legal and financial review.

- Subordinate Security: In the event of a default, the debt is secured by a second-ranking charge, meaning the risk of loss for the lender is significantly higher than for the senior lender.

What Lenders Look for in Mezzanine Financing in Real Estate

Mezzanine lenders are highly sophisticated and conduct rigorous due diligence. When evaluating a proposal for mezzanine finance for property development, they focus on:

- The Sponsor’s Track Record: A proven history of successfully completing similar property development projects is non-negotiable.

- Project Viability: A detailed and credible business plan, including realistic costings, timelines, and a clear path to profitability (often measured by Gross Development Value).

- The Quality of the Asset: The location, condition, and market potential of the commercial property are scrutinised.

- The Senior Debt: The terms and reputation of the senior lender are important, as the mezzanine lender’s position is directly linked to theirs.

- A Clear Exit Strategy: Lenders need to see a well-defined plan for how their loan will be repaid, typically through a sale of the asset or refinancing upon stabilisation.

This level of scrutiny is why a strong proposal is essential when seeking any form of commercial real estate financing.

Example of Mezzanine Financing in Real Estate

Consider a property developer planning a £100m commercial property acquisition and refurbishment.

- Total Project Cost: £100 million

- Senior Debt: A bank provides a senior loan of £60 million (60% Loan-to-Cost).

- Developer’s Equity Contribution: The developer commits £20 million (20%).

- Funding Gap: £20 million

Instead of sourcing another equity partner and diluting their stake, the developer secures a £20 million mezzanine loan. The terms might include a 14% interest rate and warrants for a 10% equity interest in the project upon completion.

This type of CRE financing allows the project to proceed, preserves the developer’s majority control, and offers the mezzanine lender a high-yield debt return with potential equity upside.

Frequently Asked Questions About Mezzanine Financing in Real Estate

❓ What is mezzanine financing in real estate?

Mezzanine financing in real estate is a hybrid form of capital that sits between senior debt and equity in the capital stack. It allows developers to bridge funding gaps without giving up significant ownership, often combining higher interest rates with equity-like features such as warrants or options.

❓ How does mezzanine financing compare to preferred equity?

Both mezzanine financing and preferred equity fill the gap between senior debt and common equity, but mezzanine is structured as debt and ranks higher in the repayment hierarchy. Preferred equity is more flexible but riskier for investors, while mezzanine loans often come with fixed terms and interest payments.

❓ When should a real estate developer use mezzanine financing?

Mezzanine financing is best used when senior debt isn’t sufficient to cover a project’s cost and the developer wants to avoid equity dilution. It’s ideal for bridging capital shortfalls, accelerating growth, or funding time-sensitive acquisitions without losing control of the project.

Conclusion: The Strategic Value of Mezzanine Financing in Real Estate

For sophisticated property developers, investors, and C-suite decision-makers, mezzanine finance in real estate goes beyond real estate finance basics; it’s a strategic enabler. It provides the flexibility and capital to bridge the gap between senior debt and equity, unlocking the potential of ambitious commercial real estate ventures across the UK, Europe, and Asia-Pacific.

While the higher cost and complexity require careful consideration, its ability to maximise leverage and preserve ownership makes it an indispensable part of modern development finance. By understanding how to effectively integrate this hybrid of debt and equity into the capital stack, you can gain a significant competitive advantage, pursue larger projects, and optimise your return on investment.

Next Steps

If you are evaluating a commercial real estate project and require a strategic financing partner, contact Forbes Le Brock today. Our team specialises in structuring complex capital solutions, including mezzanine finance and asset based lending. We can help you navigate the intricacies of the capital stack to unlock the full potential of your next venture.

🧠 No time to read? Get the key points of mezzanine financing in real estate in this deep dive discussion. 🎧 Catch it now!