Tech Stock Correction: 5 Lessons from Those Who Thrive in Market Turbulence in 2025

The relentless climb of tech stocks, particularly on indices like the Nasdaq, often feels like the new normal. Yet, seasoned investors and business leaders understand a fundamental market truth: corrections are not a matter of if, but when. When the headlines scream “” or “Technology stocks fell sharply,” panic can set in for the unprepared. However, for the strategic mind, a technology reset isn’t just a challenge to endure; it’s a period ripe with opportunity.

Market turbulence, characterised by increased volatility and sharp selloffs, tests the mettle of even the most experienced players. We’ve seen the Nasdaq Composite dip into downturn territory multiple times, sometimes triggered by macroeconomic shifts, changing interest rate environments, geopolitical tensions involving tariffs, or simply high valuations meeting reality. The recent performance of indices like the Hang Seng Tech Index also highlights the global nature of these adjustments, impacting Chinese technology shares like Alibaba alongside their U.S. counterparts.

This post delves beyond the alarming headlines of tech stock correction. We will explore the lessons learned from those who don’t just survive but thrive during these periods. For C-suite executives steering tech companies, HNWIs managing significant assets, and astute investors seeking long-term growth, understanding how to navigate a Bearish phase is paramount. We’ll examine strategic approaches, the critical role of portfolio rebalancing, and how to maintain a competitive edge when the market tide turns.

🔊 No time to read? Tune into this podcast-style discussion for a detailed review of this latest blog post. 🎧Catch it now!

What Exactly is a Tech Stock Correction? Demystifying the Dip

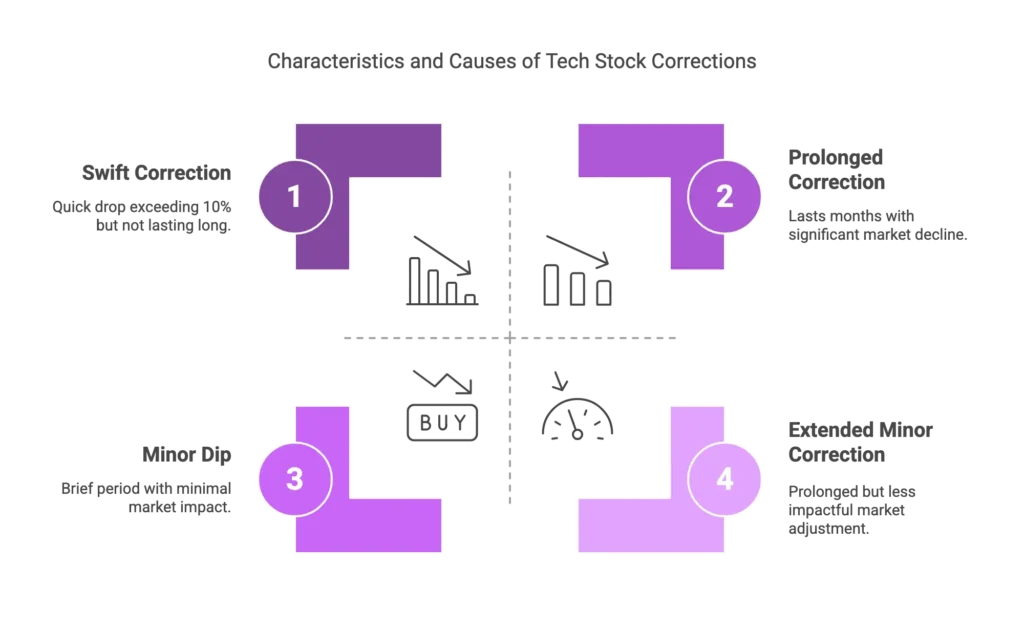

Before diving into strategies, let’s clarify the terminology. A tech stock correction is generally defined as a decline of 10% to 20% in a stock market index or the price of an individual asset from its recent peak (often the March 18 high or another significant all-time high). When this happens specifically within the technology sector, heavily impacting indices like the Nasdaq or specific tech-focused ETFs, we refer to it as a technology stock correction.

Key characteristics include:

- Magnitude: A drop exceeding 10% but less than the 20% threshold that typically defines a bear market.

- Duration: Corrections can be swift or last for weeks or months.

- Cause: Often triggered by factors like overvaluation concerns, rising interest rates (which disproportionately affect growth stocks), regulatory scrutiny, trade policies and impact of tariffs (like those discussed under President Donald Trump or potential future policies impacting Canada and Mexico or Chinese markets), profit-taking, or negative market sentiment.

- Impact: Can cause significant market volatility, leading stocks to slide across the board, though tech often bears the brunt due to its typically higher valuations. We often see headlines like “stocks fell” or “index fell” dominating financial news.

Understanding this is a normal part of the market cycle is the first step towards navigating them effectively. They shake out excesses, reset valuations, and can lay the groundwork for the next phase of growth.

Why Tech Stocks Are Prone to Corrections: Understanding the Dynamics

The technology sector’s susceptibility to downturns from several inherent characteristics:

- High Growth Expectations & Market Pricing: Tech companies, particularly those driving AI and disruptive innovations, often command premium stock prices based on ambitious growth projections. When market sentiment cools or forecasts adjust, these lofty expectations can lead to sharp corrections. The AI adoption narrative remains a strong long-term driver but can fuel short-term volatility.

- Interest Rate Sensitivity: Many tech firms depend on borrowed capital for rapid expansion or have stock prices tied to future earnings. As interest rates rise, higher borrowing costs and lower discounted future profits can make these stocks less appealing.

- Concentration Risk: Indices like the Nasdaq Composite are heavily weighted towards a few mega-caps (like Nvidia, Apple, Microsoft). A downturn in these giants can pull the entire index into adjustment territory.

- Geopolitical and Regulatory Factors: Global supply chains, international sales exposure (Chinese technology, emerging markets), and evolving regulations (data privacy, antitrust) create unique risks. Concerns over tariffs or reciprocal tariffs can significantly impact market sentiment towards tech.

- Rapid Innovation Cycles:While a strength, rapid innovation also means rapid obsolescence. Companies that fail to adapt can quickly underperform. The rise of the AI ecosystem exemplifies this dynamic pace.

Lesson 1: The Power of Perspective – Playing the Long Game

The most successful investors and leaders view a tech stock correction not as a catastrophe, but as a temporary, albeit potentially painful, event within a long-term strategy.

- For Investors & HNWIs: Panic selling during a sell-off often locks in losses. Those who thrive maintain discipline, focusing on their long-term financial goals and the fundamental value of their holdings. They understand that market timing is notoriously difficult; staying invested in quality assets often yields better total return over time. As Mark Cuban and other seasoned investors often imply, conviction in your long-term thesis is crucial.

- For C-Suite Leaders: A reset demands steady leadership. It’s a time to communicate transparently with stakeholders (investors, employees, customers), reaffirm the company’s long-term vision and strategy, and focus on execution. Short-term stock price fluctuations shouldn’t derail long-term investments in innovation (like AI data infrastructure or R&D) or core business strengths. Confidence from leadership can significantly influence market sentiment towards the company.

Lesson 2: Strategic Portfolio Rebalancing – The Cornerstone of Resilience

his is where our secondary keyword, Portfolio Rebalancing, takes centre stage. It’s arguably one of the most critical actions during market turbulence. Rebalancing involves periodically buying or selling assets to maintain a predetermined or desired level of asset allocation.

- Why Rebalance During a Correction?

- Risk Management: A sustained tech rally might leave your holdings over-allocated to the sector, increasing risk. A tech stock correction highlights this imbalance. Rebalancing forces you to trim overweight positions (potentially locking in some gains even during a downturn) and reallocate to underweight assets.

- Disciplined Buying: As tech shares fell, their weighting in your assets decreases. Rebalancing prompts you to buy more of these assets at lower prices, adhering to the “buy low, sell high” principle in a systematic way.

- Maintaining Strategy: It ensures your investments stay aligned with your long-term risk tolerance and investment objectives, preventing emotional decisions from dictating asset mix.

- Approaches to Rebalancing:

- Calendar Rebalancing: Reviewing and adjusting your assets on a regular schedule (e.g., quarterly, annually).

- Threshold Rebalancing: Adjusting only when an asset class deviates from its target allocation by a specific percentage (e.g., 5% or 10%). This is often preferred during volatile periods like a tech stock correction.

Effective portfolio rebalancing is a hallmark of sophisticated asset management, employed by HNWIs and institutional investors alike to navigate market volatility.

Leveraging Financial Tools for Rebalancing: The Role of SBL

A practical challenge during a correction can be liquidity. Selling assets at depressed prices to rebalance might feel counterintuitive or crystallise losses. This is where Securities-Based Lending (SBL) can be a powerful tool for HNWIs and investors. By borrowing against the value of your existing investments (stocks, bonds, ETFs), you can access cash for rebalancing opportunities (buying undervalued assets) or other needs without having to sell securities in a down market. This preserves your long-term holdings while providing the flexibility to act strategically during the selloff.

Lesson 3: Quality Over Hype – Focusing on Fundamentals

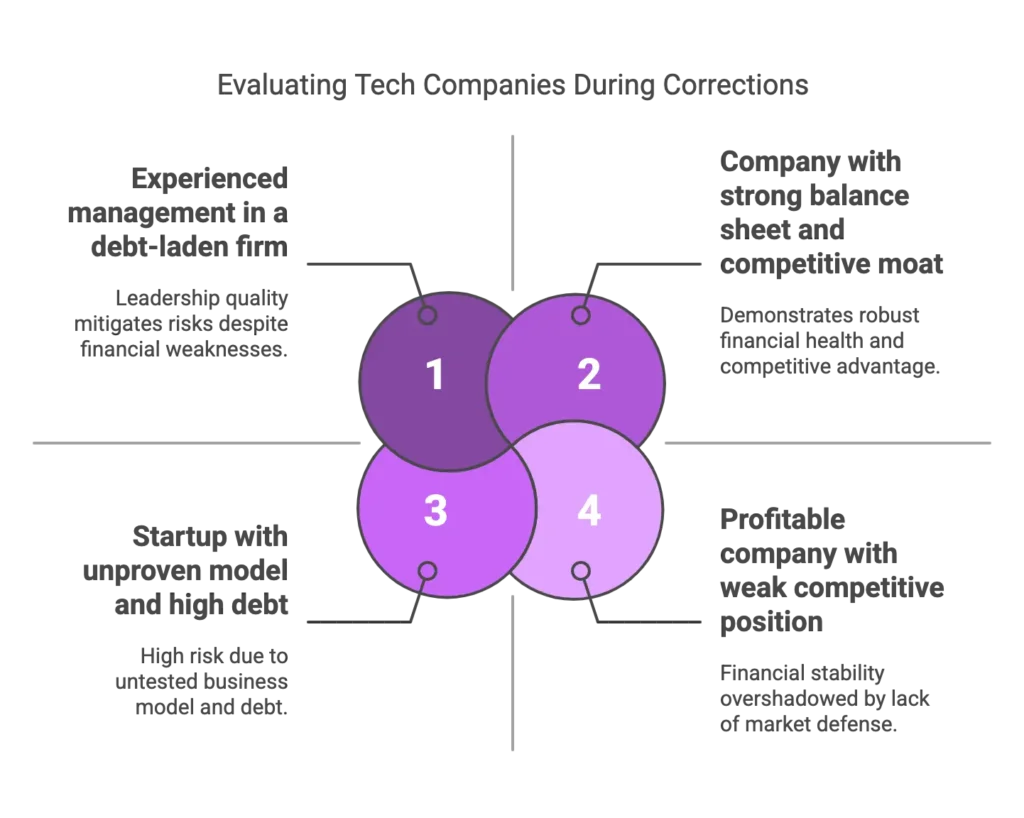

Corrections often separate the wheat from the chaff. Companies with weak fundamentals, excessive debt, or unproven business models tend to suffer disproportionately. Resilient investors and leaders shift their focus:

- Strong Balance Sheets: Companies with ample cash reserves and manageable debt are better equipped to weather economic downturns and continue investing.

- Profitability and Cash Flow: Sustainable earnings and positive cash flow demonstrate a robust business model, less reliant on external funding.

- Competitive Moat: Companies with strong brand loyalty, network effects, intellectual property, or significant market share (market value) are more defensible.

- Management Quality: Experienced and adaptable leadership (business leaders) is crucial for navigating uncertainty. Analyst reports often scrutinise management execution during these times.

During a tech stock correction, due diligence becomes even more critical. Look beyond the hype (even AI hype) and scrutinise the underlying financial health and competitive positioning of tech companies.

Lesson 4: Strategic Opportunism – Buying Wisely, Not Indiscriminately

While “buying the dip” is a common refrain, successful investors approach it strategically, not emotionally. A technology stock correction can present opportunities to acquire shares in high-quality companies at discounted prices.

- Identify Targets: Have a watchlist of fundamentally sound tech shares you believe are undervalued due to the broader market correction rather than company-specific issues.

- Scale In: Avoid trying to time the absolute bottom. Consider averaging in, buying shares in tranches as the price falls or stabilises.

- Patience: Understand that recovery may take time. Invest with capital you won’t need in the short term. The market may stay in positive territory one day and index dropped the next; focus on the long view. Daily performance is noise.

Lesson 5: Diversification – The Tried-and-True Risk Mitigator

A tech stock correction underscores the importance of diversification. While tech can be a powerful growth engine, over-concentration is a significant risk.

- Across Sectors: Ensure exposure to other sectors beyond technology (e.g., healthcare, financials, consumer staples) which may perform differently during a correction. Monitor broader indices like the S&P 500 and Dow Jones Industrial Average.

- Across Asset Classes: Include bonds, real estate (potentially via Commercial Real Estate Finance strategies), commodities, or alternative investments to buffer portfolio volatility.

- Across Geographies: While global markets are interconnected (witness the Hang Seng Tech Index movements), diversification across regions (U.S., Europe, emerging markets) can mitigate country-specific risks, though be mindful of factors like tariffs and slow economic growth in certain areas.

The C-Suite Playbook: Leading Tech Companies Through the Storm

For executives leading tech companies, a correction requires specific actions:

- Reinforce Financial Discipline: Scrutinise budgets, manage cash flow diligently, and prioritize investments with clear ROI. Delay non-essential expenditures if necessary.

- Communicate Proactively: Maintain open lines of communication with investors, analysts (Bloomberg, etc.), employees, and customers. Address concerns transparently and reiterate the long-term strategy and value proposition. Ensure daily performance updates are contextualised.

- Focus on Core Operations: Double down on product development, customer service, and operational efficiency. Market downturns can be an opportunity to gain market share if competitors falter.

- Evaluate Strategic Opportunities: Lower valuations might create M&A opportunities or chances to acquire talent.

- Leverage AI for Insights: Utilize AI in Finance tools for better forecasting, risk assessment, and understanding shifting market sentiment. AI adoption internally can also drive efficiency gains.

Case Study Snippet: The Early 2022 Tech Selloff

Corrections are cyclical. Whether driven by AI valuation resets, shifts in trade policies, unexpected economic data (first quarter results, etc.), or new stimulus measures, another tech stock correction will eventually occur. Preparation is key:

- Regular Portfolio Review: Don’t wait for a correction to assess your allocation and risk tolerance. Make portfolio rebalancing a routine discipline.

- Maintain Liquidity: Having cash or access to liquidity (like through SBL) provides flexibility to act when opportunities arise.

- Stay Informed: Understand the macroeconomic landscape, interest rate environment, regulatory changes, and geopolitical risks (including tariffs). Follow insights from your Chief Investment Officer or trusted financial advisors.

- Focus on Quality: Continuously evaluate the fundamental strength of your holdings.

Integrating Advanced Financial Strategies

For our sophisticated audience, navigating corrections involves more than just basic buy-and-hold:

- Securities-Based Lending (SBL): As mentioned, SBL offers strategic liquidity without disrupting long-term investments, crucial for seizing opportunities during market pullbacks.

- Luxury Asset Finance: While seemingly distinct, understanding the liquidity position of HNWIs is key. Market corrections might influence decisions around financing or acquiring luxury assets, potentially freeing up or requiring capital. SBL can bridge these needs.

- Commercial Real Estate Finance: Market sentiment shifts can impact CRE valuations and financing availability. Investors might reallocate capital between equities and real estate during volatile periods.

- AI in Finance: Increasingly, AI tools are used by asset management firms and HNWIs for sophisticated risk modelling, sentiment analysis, and identifying potential correction triggers or undervalued assets during a sell-off. Leveraging the AI ecosystem provides a competitive edge.

(Conclusion): Turning Turbulence into Triumph

A tech stock correction is an inherent feature of the market landscape, particularly within a dynamic and high-growth sector often driven by innovation like Artificial Intelligence. While periods when the Nasdaq or other stocks listed on the stock exchange experience sharp selloffs can be unsettling, they are not cause for panic for the well-prepared investor or business leader.

The lessons from those who thrive are clear:

- Maintain a Long-Term Perspective: Focus on fundamental value and strategic goals.

- Embrace Portfolio Rebalancing: Use it as a disciplined tool for risk management and opportunistic buying.

- Prioritize Quality: Focus on companies with strong fundamentals and resilient business models.

- Be Strategically Opportunistic: View downturns as chances to acquire quality assets at better prices.

- Diversify Effectively: Spread risk across sectors, asset classes, and geographies.

- Lead with Confidence (C-Suite): Communicate clearly and focus on execution and long-term strategy.

By understanding the dynamics of a tech stock correction, implementing disciplined strategies like portfolio rebalancing, and leveraging sophisticated financial tools like SBL and insights from AI in Finance, C-suite executives, HNWIs, and savvy investors can not only weather the storm but emerge stronger, positioning themselves for sustained success in the years ahead, including 2025 and beyond. Market turbulence tests strategies, but it also reveals opportunities for those equipped to see them.

Next Steps:

Need liquidity without selling? Our asset-based lending solutions provide capital against securities and other assets, giving you the flexibility to rebalance or seize opportunities. Get in touch to explore your options.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or legal advice. Market conditions can change rapidly, and past performance is not indicative of future results. Investing involves risk, including potential loss of principal. Readers should conduct their own due diligence and consult with a qualified financial professional before making any investment decisions.