Understanding How a Lombard Loan Works

For high-net-worth individuals, sophisticated investors, and corporate treasuries, maintaining strategic liquidity while keeping valuable assets invested is a perpetual challenge. Selling assets to raise capital can trigger unwanted taxes, disrupt long-term strategies, and incur transaction costs.

This is where a lombard loan offers a powerful, elegant solution. A lombard loan is a form of lending that allows you to lend against the value of your investment portfolio without liquidating your holdings. It’s a sophisticated financial tool used in private banking and private finance to provide rapid access to cash for diverse needs. This guide delves into how lombard loans work, their strategic benefits, and why they are a key component of modern wealth management.

What is a Lombard Loan

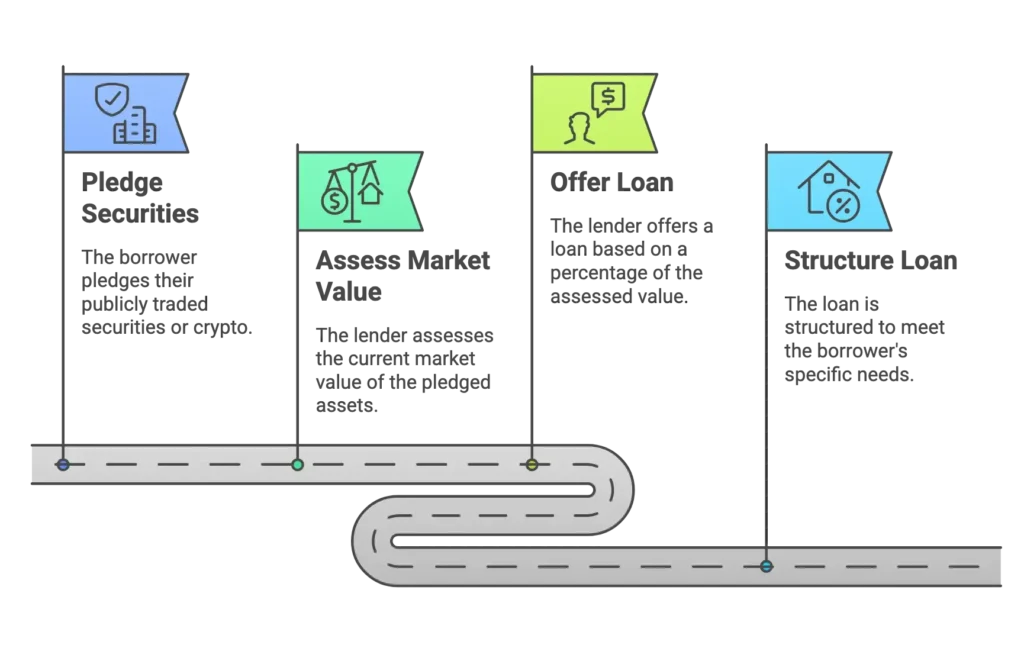

A lombard loan is essentially a securities based lending facility where marketable securities – such as stocks, bonds, mutual funds, or even alternative investments held within an investment portfolio – serve as collateral. It is a specific type of securities based lending, distinct from a standard loan against investment portfolio.

The lender provides funds based on a percentage of the value of the collateral, known as the Loan-to-Value (LTV) ratio. This ratio varies depending on the type and volatility of the underlying assets. Unlike a traditional mortgage or consumer loan, the security for a lombard loan is your portfolio itself, allowing you to borrow against the value of your existing assets. Modern-day lombard loans follow principles established centuries ago by banking houses, adapted for today’s financial markets.

Strategic Benefits of Using a Lombard Loan

- Maintain Investment Position: The primary benefit is the ability to remain invested. You avoid selling assets, preserving your long-term strategy and potentially avoiding capital gains tax.

- Rapid Access to Liquidity: Compared to traditional borrowing methods like a mortgage or a standard bridging loan, the lending process for a lombard loan is typically much faster, providing immediate access to capital.

- Flexible Fund Usage: Funds obtained through lombard credit have no restrictions on use. They can be deployed for new investment opportunities, business needs, property finance, or personal liquidity needs.

- Competitive Pricing: Lombard loan interest rates are often competitive, typically linked to base rates plus a margin, reflecting the secured nature of the lending facilities. The specific lending rate for a lombard loan will depend on the size, duration, and quality of the underlying assets.

- Non-Recourse Options: Many lombard lending facilities can be structured as non-recourse, meaning the lender’s claim is limited to the pledged security, protecting other personal assets.

These benefits of lombard loans make them a powerful tool for sophisticated financial planning.

Key Features of a Lombard Loan

When considering taking out a lombard loan, understanding its core features is crucial:

- Collateral: Eligible financial assets such as assets such as stocks, stocks and bonds as collateral, mutual funds, and other marketable securities. The value of the collateral is continuously monitored.

- Loan-to-Value (LTV): The percentage of the collateral’s value the lender is willing to advance. LTVs vary significantly based on asset class risk and market volatility. Higher LTVs may require more stringent monitoring or additional collateral.

- Interest Rates: Typically variable, tied to benchmark base rates, but fixed-rate options may be available. The lombard loan interest rates are a key factor to evaluate.

- Loan Terms: Flexible, ranging from short-term facilities to longer-term arrangements. Repayment structures can often be tailored.

- Margin Calls: A critical feature. If the value of the collateral falls below a certain threshold (due to market volatility), the lender may issue a margin call, requiring the borrower to provide additional assets or repay part of the loan to restore the LTV. Failure to meet a margin call means the pledged securities may be repossessed.

Strategic Applications for Lombard Credit

Using a lombard loan provides strategic flexibility for high-net-worth individuals and businesses looking to raise finance:

- Seizing Investment Opportunities: Quickly access capital to fund new ventures or buy additional investments when opportunities arise, without disrupting your existing diversified portfolio.

- Business Expansion: Fund operational needs, acquisitions, or expansion projects.

- Property Finance: Use a lombard loan as a flexible alternative or supplement to traditional commercial property finance for real estate purchases or development.

- Managing Cash Flow: Bridge short-term liquidity needs or manage cash flow gaps.

- Diversification: Access capital to diversify your portfolio into different asset classes or regions.

- Tax Planning: Manage cash needs without triggering capital gains by selling appreciated assets.

- Providing a Bridging Loan: Act as a rapid form of short-term financing.

A lombard loan allows you to borrow against the value of your portfolio without the need to sell, providing liquidity without sacrificing your long-term investment goals.

Risks and Considerations in Lombard Lending

While beneficial, lombard lending is not without risk. The primary risk is market volatility. A significant downturn in the financial markets could reduce the value of the collateral, potentially leading to margin calls. Borrowers must be prepared to meet these calls by providing additional collateral or making partial repayments to keep up repayments.

It’s crucial to work with a knowledgeable lender or broker who understands your investment portfolio and can structure the lombard loan appropriately, setting realistic LTVs and helping you understand the potential impact of market volatility.

Why Partner with Forbes Le Brock for Your Lombard Loan?

Navigating the sophisticated world of lombard lending requires expertise and access to the right lending facilities. At Forbes Le Brock, we specialise in structuring tailored lombard loan solutions for private wealth clients and high-net-worth individuals.

We understand the nuances that banks offering lombard loans use and leverage our relationships to secure the most favourable terms for you. Our focus is on providing strategic private finance solutions that align with your overall wealth management objectives, ensuring you can access liquidity efficiently and effectively.

Access Strategic Liquidity Without Selling Assets

Conclusion & Next Steps

A lombard loan is a powerful and flexible tool for unlocking capital from your investment portfolio. It allows you to remain invested while accessing the liquidity needed to seize new financial opportunities, manage cash flow, or meet personal or business needs. For high-net-worth individuals and sophisticated investors, it represents a strategic alternative to selling assets.

If you are looking to raise finance efficiently through sophisticated private finance and explore how a lombard loan can work for you, get in touch with Forbes Le Brock. We serve clients across the UK, Europe & Asia-Pacific, providing expert guidance on lombard lending and helping you put your assets to work. Let us help you access the strategic capital you need.