Loan Against Investment Portfolio: A Smarter Way to Access Capital

Accessing significant capital doesn’t have to mean disrupting your carefully constructed investment portfolio. For high-level financial decision-makers, including HNWIs, investors, C-suite executives, asset and fund managers, strategic borrowing is a critical tool in wealth management.

Discover how a loan against investment portfolio, often structured as a securities-backed line of credit, can provide the liquidity you need without selling valuable assets.

This guide explores this sophisticated borrowing option, detailing how investors can lend against the value of their investment portfolios. Unlocking, immediate liquidity needs without sacrificing long-term investment strategies.

Leveraging your Investment Portfolio: Understanding a Loan Against Investment Portfolio

For sophisticated investors and C-suite executives, managing liquidity while preserving long-term investment strategies is paramount. Selling assets to access cash can trigger capital gains taxes, disrupt carefully crafted portfolio allocations, and potentially miss out on future market appreciation.

This is where a loan against investment portfolio emerges as a powerful financial tool. This sophisticated borrowing strategy allows you to borrow against the value of your eligible securities without having to sell them.

This comprehensive guide delves into the intricacies of obtaining a loan against investment portfolio, exploring its benefits, risks, and practical applications for high-level decision-makers. We will examine how these lending solutions differ from traditional financing options, such as a margin loan, and provide actionable insights for maximising their strategic value. This type of financing is also sometimes referred to as securities based lending.

What is a Loan Against Investment Portfolio? Defining Securities-Backed Lending

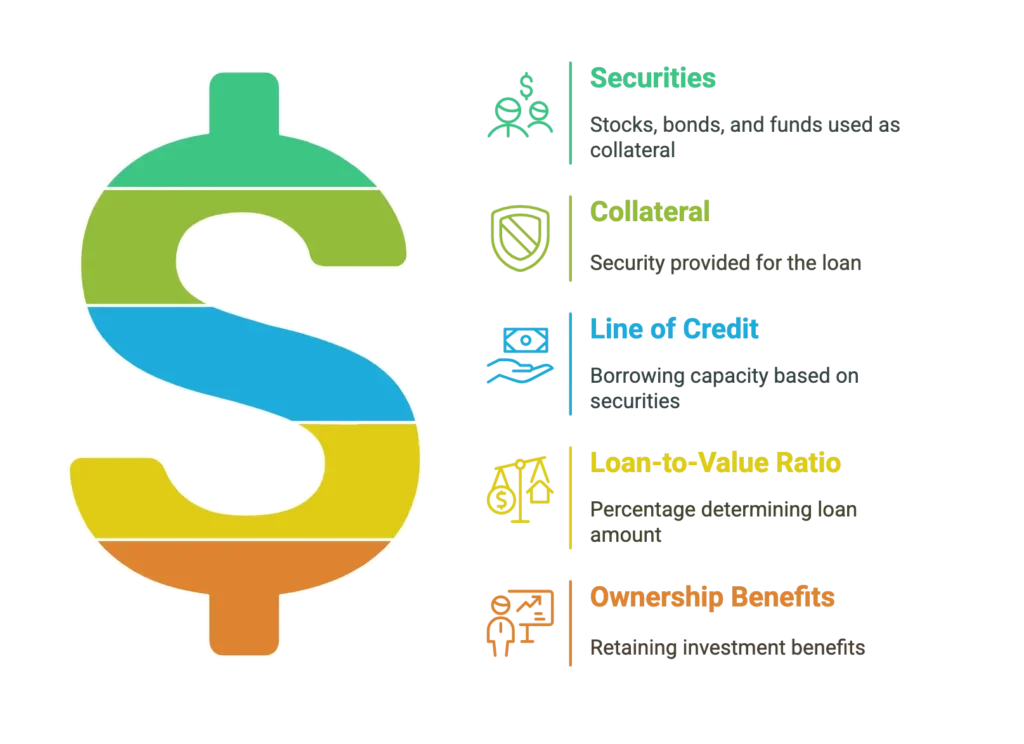

A loan against investment portfolio is a type of financing where you use your eligible listed securities (listed stocks, bonds, ETFs, mutual funds) as collateral to secure a loan or a line of credit. Unlike traditional finance, where you might pledge real estate or other tangible assets, this approach leverages the market value of your existing investment portfolio. This is a form of investment-backed lending, also known as portfolio lending or securities-backed financing. It can also be referred to as a lombard loan in some contexts.

The loan value you can access is typically a percentage of the value of your pledged securities, known as the loan-to-value (LTV) ratio. This ratio varies depending on the lender, the type of securities pledged, and current market conditions.

Strategic Benefits of a Loan Against Your Investment Portfolio

Obtaining a loan against investment portfolio offers numerous advantages for sophisticated borrowers:

- Liquidity Without Liquidation: This is the primary benefit. Access ready access to capital for various needs – commercial real estate purchases, business investments, unexpected expenses, or even bridging short-term cash flow gaps – without selling your investments and potentially incurring capital gains taxes.

- Maintain Investment Strategy: Keep your investment portfolio intact, allowing you to continue to benefit from potential market growth and dividend income. This is particularly crucial for investors with long-term investment horizons and carefully constructed asset allocations.

- Competitive Interest Rates: Securities-backed lending solutions often offer competitive interest rates, that can be fixed or variable rates tied to benchmarks. These lower interest rates can be significantly lower than those of unsecured finance or credit, reducing your borrowing costs.

- Flexibility and Speed: Accessing borrowed funds can be quick and efficient, often with streamlined application processes compared to traditional finance like a home equity line of credit. The line of credit allows flexibility – draw from your line as needed and repay the loan based on the terms of your agreement.

- Tax Advantages (Consult with a Tax Advisor): In some cases, the interest on the loan secured by investments to secure the funds may be tax-deductible, depending on how the borrowed funds are used. Always consult with a qualified tax advisor to determine the potential tax implications for your specific situation.

- No Prepayment Penalties (Typically): Some securities-based lines of credit do not have prepayment penalties, allowing you to repay the loan balance whenever you have extra cash available. Fixed-term portfolio loan structures may have different terms regarding early repayment.

Navigating the Risks of Borrowing Against Your Investment Portfolio

While borrowing against your investments offers significant advantages, it’s crucial for sophisticated borrowers to understand and manage the associated risks:

- Market Volatility: The value of your investment portfolio can fluctuate. If the market value of your collateral declines significantly, you may face a margin call.

- Margin Call: A margin call occurs when the value of your pledged securities falls below a certain threshold, requiring you to deposit additional cash or securities to maintain the required LTV ratio. Failure to meet a margin call can result in the lender liquidating some or all of your pledged securities to cover the outstanding loan.

- Interest Rate Risk: While variable rates can be advantageous when rates are low, they can also increase, potentially raising your borrowing costs.

- Not Suitable for All Investments: Certain types of securities may not be eligible as collateral, or they may have lower LTV ratios.

- Complexity: Securities-based lending can be more complex than traditional loans, requiring a thorough understanding of the terms and conditions.

- Potential for Loss: Market conditions can magnify any potential for loss. The use of margin involves a high degree of risk and is not suitable for all investors. You should carefully consider your investment objectives, level of experience and risk appetite before undertaking any margin transactions.

Loan Against Investment Portfolio vs. Margin Loans: Key Distinctions

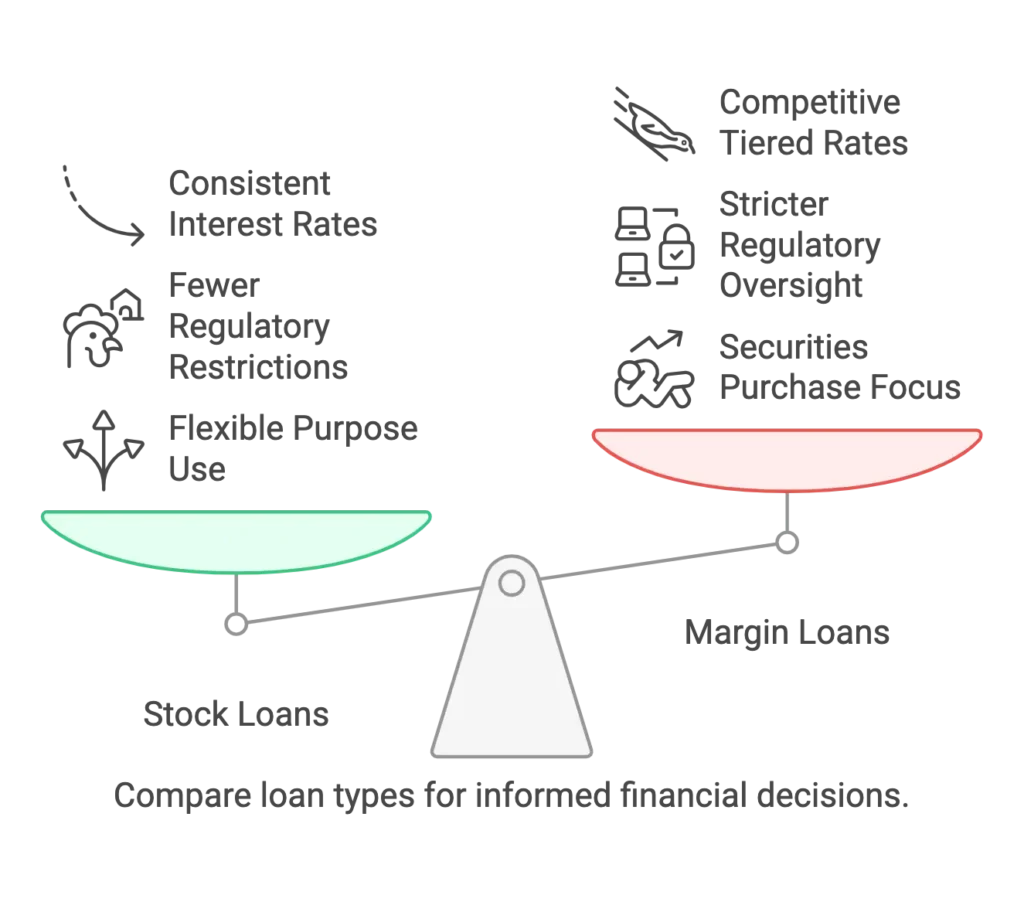

While both securities-backed lending and margin loan facilities allow you to borrow against the value of your investment accounts, there are crucial distinctions relevant to high-level borrowers:

- Purpose: Margin loans are typically used to purchase additional securities within the same brokerage account, increasing leverage and potential returns (and losses). A loan against investment portfolio (or securities-based line of credit) can be used for a wider range of purposes, including non-investment-related expenses, offering greater flexibility.

- Regulation: Margin loans are subject to stricter regulations, such as those set by financial authorities like the European Securities and Markets Authority (ESMA) and national regulators, which impose limits on borrowing against securities. In contrast, asset-backed loans secured by a broader investment portfolio may offer more flexibility depending on the lender and jurisdiction.

- Interest Rates: Margin loan interest rates can be competitive but are often tiered based on the loan balance. Loans and lines of credit secured by a portfolio may offer more consistent variable interest rate structures or even fixed rates.

- Use Restrictions: Margin loans typically restrict the use of borrowed funds to buying other securities, whilst a loan against investment portfolio allows for greater flexibility of use (although cannot always be used to purchase additional securities).

Real-World Application: Using a Loan Against an Investment Portfolio for Strategic Initiatives

Let’s consider a scenario relevant to a sophisticated investor: Sarah, a successful entrepreneur, wants to invest $10 million in a new business venture. She doesn’t want to sell her substantial stock holdings in a publicly-traded technology company, as she believes these shares will continue to appreciate significantly, aligning with her long-term investment strategy.

Instead of liquidating her investment portfolio, Sarah opts to take out a portfolio loan against investment portfolio. She pledges a portion of her stock portfolio as collateral and secures a portfolio loan with a favorable, fixed interest rate over a 3-year term. This allows her to access the $10 million she needs to fund her business venture while maintaining her ownership of the technology company stock.

Over time, Sarah’s business venture thrives. She uses the profits generated by the business to cover the monthly interest payments on her loan. As the value of your portfolio increases, her LTV ratio improves, further reducing her risk.

This example illustrates how asset-backed lending can be a powerful tool for HNWIs seeking to leverage their existing investment portfolio to pursue new opportunities without disrupting their long-term investment strategies and to grow and preserve your wealth.

Selecting a Lender and Structuring Your Loan Against an Investment Portfolio

Choosing the right lender and structuring your loan against investment portfolio are critical steps for high-level borrowers. Consider the following factors:

- Lender Reputation and Experience: Flip the table and carry out borrower due diligence on a selection of lenders, look for reputable financial institution with extensive experience and track record in portfolio lending, such as a private bank or a well-established fund.

- Loan-to-Value (LTV) Ratios: Compare LTV ratios offered by different lenders for various types of securities. Understand the factors that influence LTV, such as the security’s liquidity, volatility, and concentration. This impacts the amount you can borrow.

- Interest Rates and Fees: Carefully review the interest rate structure (fixed or variable interest rate), any associated fees (origination fees, maintenance fees), and the terms of repayment. Understand the total borrowing costs.

- Margin Call Procedures: Understand the lender’s margin call procedures, including the notification process, the time frame for meeting the call, and the consequences of failing to do so. How quickly must you meet a margin call?

- Flexibility and Customization: Assess the lender’s willingness to customise the loan terms to meet your specific needs and financial situation. A line of credit allows for flexible drawdowns.

- Loan Documents: Read and understand the loan documents thoroughly. Given the complexity and potential risks, obtaining legal advice is highly recommended before committing to borrowing against your investments.

Conclusion: A Strategic Financial Tool for High-Level Decision-Makers

A loan against investment portfolio, whether structured as a portfolio loan or a securities-based line of credit, is a powerful financial tool that can provide HNWIs, investors, and C-suite executives with significant advantages. It allows you to access liquidity without liquidating your investments, maintain your long-term investment strategy, and potentially benefit from competitive interest rates.

However, it’s crucial to approach investment-backed lending with a clear understanding of the risks involved, particularly market volatility and the potential for a margin call. By carefully evaluating your financial situation, choosing a reputable lender, structuring your loan prudently, and implementing risk management strategies, you can effectively leverage this tool to achieve your financial goals and grow and preserve your wealth.

Next Steps: Unlock Liquidity Without Selling Your Stocks

A loan against investment portfolio provides ready access to capital by allowing you to borrow against the value of your assets while keeping your investment portfolio intact.

Explore your borrowing options today with one of our experts at Forbes Le Brock. Understand the risks and benefits specific to your situation. Secure a tailored lending solution that fits your strategic financial goals.

Don’t let illiquidity hinder your opportunities—put your assets to work. We serve clients across the UK, Europe & Asia-Pacific. Contact us today