2025 Borrower Due Diligence Toolkit: How to Identify the Right Lender Early

Introduction: Why Borrower Due Diligence Matters When Shortlisting Lenders

In high-value lending transactions, whether for commercial real estate, securities-based loans, or alternative finance, borrower due diligence isn’t optional, it’s a strategic necessity. While lenders rigorously assess a borrower’s ability to repay, borrowers must conduct borrower due diligence on the lender, loan terms, and transaction structure. Vetting lenders is a crucial step is often overlooked, but can be a game changer.

A strong borrower due diligence process protects against predatory lending practices, ensures alignment with strategic objectives, and helps you avoid costly legal or financial pitfalls. Whether you’re a C-suite executive, investor, or high net worth individual (HNWI), this borrower due diligence guide is for borrowers seeking to secure, high value loans and avoid lender-side risk.

Borrower Due Diligence Process: Flipping The Script

Borrower due diligence is a thorough evaluation of the lender’s credentials, loan terms, transaction details, and legal structure. Its goal is to ensure the deal aligns with your financial interests and strategic objectives.

Key Objectives of the Due Diligence Process:

- Verify lender credibility and ethical lending practices

- Understand all terms in the loan agreement

- Identify hidden costs, legal issues, or collateral risks

- Mitigate potential governance and compliance failures

- Ensure strategic fit with your financing needs

Borrower due diligence transforms a loan from a quick funding fix into a strategic financial asset.

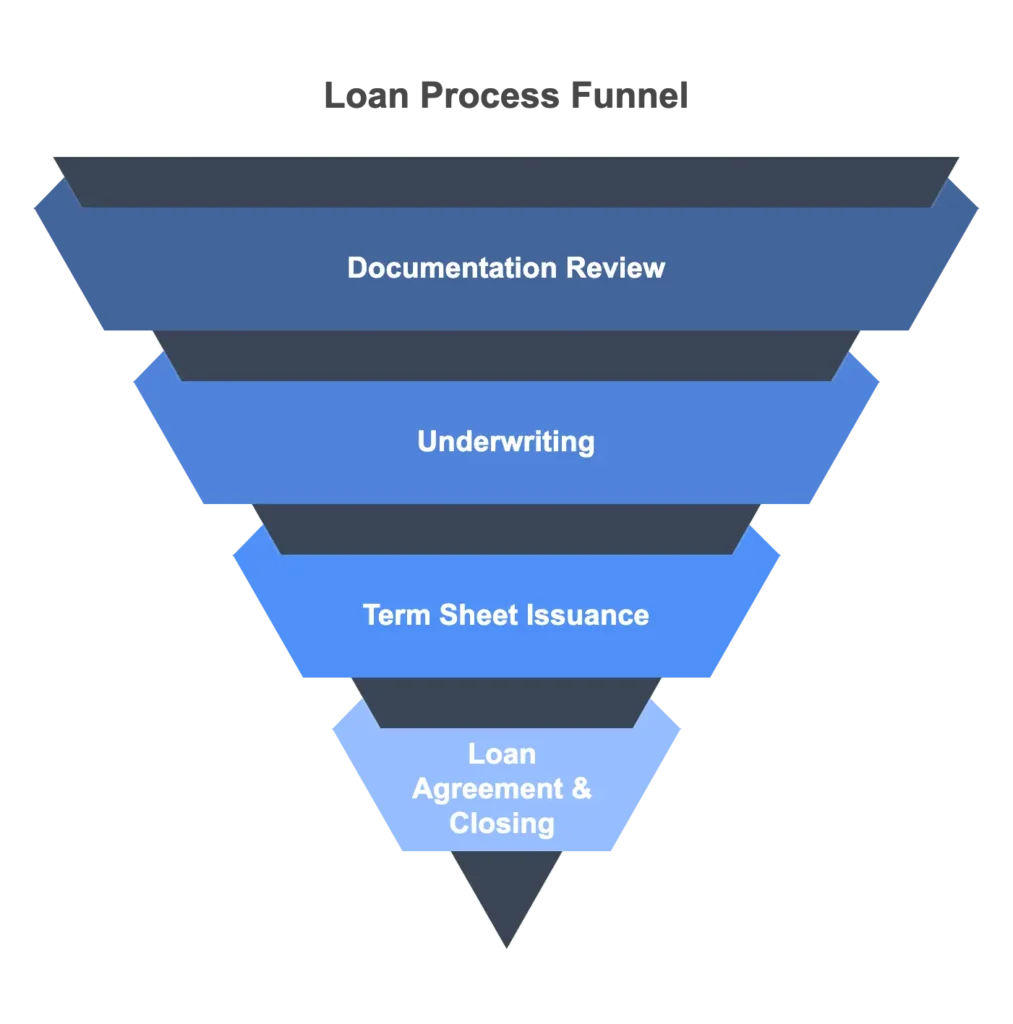

The Loan Process: Key Steps Every Borrower Should Understand

Understanding the loan lifecycle helps pinpoint where borrower due diligence is most effective:

1. Loan Application

- Submit preliminary documentation and express funding needs.

- DD Focus: Evaluate how your information is handled, including confidentiality and transparency.

2. Documentation & Initial Review

- Lenders can request detailed financials, asset listings, and business info.

- DD Focus: Understand exactly what you’re being asked to provide and why. Ensure NDAs or data-sharing policies are in place.

3. Underwriting

- The lender assesses risk, collateral value, and repayment ability.

- DD Focus: Ask what metrics or models they’re using to evaluate your profile.

4. Term Sheet Issuance

- Preliminary loan conditions are outlined.

- DD Focus: Scrutinise rate structure, covenants, loan-to-value (LTV), and repayment terms before proceeding.

5. Loan Agreement & Closing

- Final documents are drafted and signed.

- DD Focus: Engage legal counsel to review the full loan agreement. Confirm all terms match the approved term sheet.

A borrower’s credit history, current cash flow, and any existing liability obligations can all play a key role in a lender’s decision making process, and should be reviewed internally before applying.

Borrower Due Diligence Checklist: How to Evaluate the Lender and the Loan

Use this due diligence checklist to ensure nothing falls through the cracks:

✅ Verify Lender Credentials

- Licenses, jurisdictional registration, and regulatory standing

- Financial strength and underwriting track record

- Independent reviews or references

✅ Evaluate Loan Terms

- Total cost of capital (APR, not just headline rate)

- All fees: origination, legal, servicing, prepayment, balloon payments

- Flexibility for early repayment or restructuring

- Conditions tied to collateral and default clauses

✅ Assess Transparency & Ethics

- How clearly are fees, risks, and terms disclosed?

- Is the lender responsive and professional during the process?

- Do they engage in transparent lending practices or hide terms in the fine print?

✅ Understand Legal Implications

- Jurisdiction and governing law of the agreement

- Default definitions and lender enforcement rights

- Any clauses that may limit recourse or create exposure to excessive penalties.

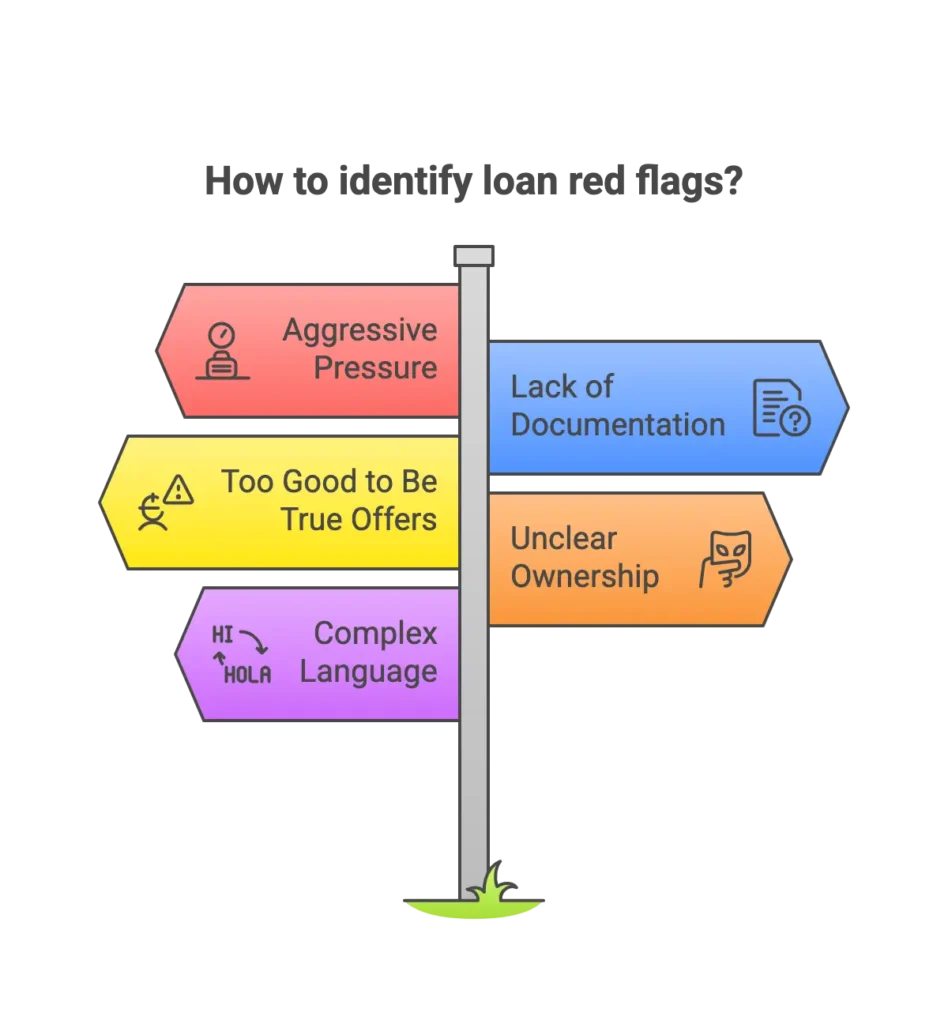

Loan Red Flags Borrowers Should Never Ignore

Even in high-value deals, red flags can emerge that signal risks or bad faith lending. Spot them early.

🚩 Aggressive Pressure

If a lender rushes you to sign documents before legal counsel reviews them, pause.

🚩 Lack of Documentation

A serious lender should provide a full draft loan agreement and answer every question about it.

🚩 Too Good to Be True Offers

Unrealistically low rates or no documentation loans often come with hidden terms or excessive collateral risk.

🚩 Unclear Ownership or License Status

Anonymous lenders, offshore entities without clear regulation, or shell companies present massive risk.

🚩 Complex Language Meant to Confuse

Legal jargon or vague language around covenants and default rights can be a deliberate obfuscation tactic.

Case Insight: Why Clarity Matters in Lombard Lending

A prospective borrower was presented with terms on a Lombard loan featuring a low headline interest rate. Upon reviewing the agreement with counsel, it became clear that:

- There was no cap or transparency around rehypothecation

- Margin call clauses were vague, leaving the borrower exposed in market downturns

- The lender had full discretion over collateral use, without independent custody

This structure wasn’t inherently unethical, rehypothecation and leverage are normal tools in structured lending. But the lack of disclosure and borrower protections was a red flag. The client ultimately opted for a more transparent structure, where:

- Rehypothecation was permitted within defined limits

- Margin calls were based on clear, quantifiable triggers

- An independent custodian safeguarded the pledged assets

The lesson? It’s not about rejecting leverage, it’s about ensuring borrower rights, transparency, and informed consent are built into the deal.

P2P Lending: Key Risks for Sophisticated Borrowers

Peer-to-peer (P2P) lending often through online platforms that match borrowers directly with individual or institutional lenders. While this can be attractive for borrowers who face delays or roadblocks with traditional banks, especially in time sensitive situations, the speed and accessibility can come at the cost of reduced scrutiny. This makes proper evaluation absolutely essential, particularly for borrowers seeking high value funding or operating in regulated sectors.

- Lack of traditional compliance or banking oversight

- Vague underwriting standards

- No deposit protection or insurance

- Platform solvency and governance concerns

When evaluating P2P options, your borrower due diligence must go beyond the displayed terms. Investigate the platform’s financial health, history of successful deal execution, investor protection mechanisms, and the jurisdiction in which it operates. For borrowers involved in asset-backed or cross border transactions, confirm how the platform manages collateral, dispute resolution, and data security. Treat the platform itself as you would a counterparty, interrogate its credibility before committing capital or exposing sensitive information.

Lending Best Practices for Sophisticated Borrowers

To reduce risk and secure favorable terms in any lending transaction, apply these best practices:

- Start Early: Avoid desperation borrowing. Give time to assess multiple offers.

- Compare Term Sheets: Benchmark key terms across at least 2–3 lenders.

- Engage Legal Counsel: Never sign a commercial loan agreement without a legal review.

- Negotiate from Strength: Use your financial profile and asset quality to negotiate rates, covenants, or collateral terms.

- Maintain Records: Keep detailed documentation of offers, changes, and conversations.

- Ask Questions: Don’t accept vague answers. Clarify every clause in the loan agreement.

Even in fast moving transactions, discipline and structure matter. By approaching each deal with strategic intent, you’ll minimise downside risk and maximise longterm value.

Building Trust in Financial Services: A Two-Way Street

True trust in financial services depends on transparency, ethics, and open communication, on both sides. Borrowers who do their homework, ask hard questions, and bring in expert advisors are more likely to:

- Avoid legal and financial pitfalls

- Secure long-term financing partnerships

- Protect their reputation and assets

Trust isn’t automatic, it’s earned through informed decisions and mutual accountability. By treating lender evaluation as seriously as lenders assess you, you build the foundation for stable, transparent, and high-value financial relationships.

Conclusion: Make Borrower Due Diligence Your Strategic Advantage

In any high value loan transaction, your power as a borrower comes from preparation, due diligence, and expert negotiation. Don’t just accept funding, scrutinise it.

By applying the same discipline lenders use to assess you, you move from borrower to equal partner in the lending process.

📩 Take Action: Considering a high value loan or asset-backed finance? Contact us to make sure your due diligence protects your interests.

Forbes Le Brock serves clients across the UK, Europe and Asia-Pacific.

Common Borrower Due Diligence Q&As

1: What is borrower due diligence, and why does it matter?

Borrower due diligence is the process where borrowers carefully evaluate potential lenders, loan terms, and structures to ensure the deal fits their financial goals and risk tolerance.

2. What are common lender red flags borrowers should watch for?

Vague loan terms, unclear fee structures, lack of regulatory compliance, and poor communication are key warning signs

3. Why is due diligence from the borrower side important?

It helps borrowers avoid wasting time with unsuitable lenders, uncover hidden risks, and negotiate better loan terms for high value financing.

4. How does lender due diligence differ?

Lender due diligence focuses on assessing the borrower’s ability to repay, while borrower due diligence involves vetting the lender’s credibility, loan conditions, and compliance

5. Do I need legal counsel for private lending deals?

Absolutely, but not required. Expert legal advice is critical to review contracts and spot hidden liabilities.

6. Can it protect me from financial fraud?

Yes. Thorough checks and legal advice reduce the risk of falling victim to scams or unfavourable contracts.

7. When should I start vetting lenders?

Start early, before engaging deeply with lenders, to save time and avoid costly mistakes.

🔥 Rather Listen to: Borrower Due Diligence: Essential 2025 Guide? Listen to this Deep Dive. 🎙️Tune in now!