How AI in Credit Risk Management is Changing Lending Decisions in 2025

In today’s shifting financial landscape, managing credit decisions is essential for HNWIs, corporate treasurers, and institutional investors. Traditional risk assessment methods struggle with the vast amount of data now available, but AI in credit risk management offers a powerful solution. McKinsey reports: “Artificial Intelligence could add $1 trillion in value to banks annually, with much of that from improved credit

assessments”. With fluctuating interest rates, geopolitical instability, and changing regulations, traditional credit scores and historical data are no longer enough. This post explores how AI is transforming lending decisions, highlighting trends, challenges, and best practices to help you optimize your credit strategies and protect your wealth.

Understanding AI in Credit Risk Management

AI in credit risk management uses artificial intelligence and machine learning algorithms to analyse both structured and unstructured data, identifying patterns beyond traditional credit scoring. This approach creates a more dynamic and comprehensive risk profile. Unlike static traditional models, AI adapts to market conditions and borrower behaviour, offering:

- Accurate Risk Assessment: Identifying early signs of potential default.

- Faster Decision-Making: Speeding up loan approvals with automated processes.

- Reduced Losses: Minimising credit losses by detecting high-risk borrowers.

- Enhanced Fraud Detection: Spotting unusual patterns of fraudulent behaviour.

- Improved Regulatory Compliance: Helping institutions meet evolving regulations.

Real-World Example: For a large corporation seeking credit, it can analyse not only financial statements but also news sentiment, social media trends, and macroeconomic factors, offering a fuller view of creditworthiness.

Case Study: JPMorgan Chase used AI to automate credit decisioning, reducing loan processing time and decreasing defaults, success replicated by many other banks.

Best Practices for Using AI in Credit Risk Management Effectively

Successfully implementing AI in credit risk management requires strategic planning. Consider these best practices:

- ✅ Start with Clear Objectives: Define your goals, whether reducing defaults, improving efficiency, or enhancing fraud detection. Clarifying objectives ensures your strategy aligns with your needs, whether managing a diverse portfolio or focusing on specific lending types.

- ✅ Invest in High-Quality Data: AI algorithms are only as effective as the data they analyse. Ensure access to comprehensive, accurate, and up-to-date data, including traditional financial data and alternative sources like social media, reviews, and transactions. More diverse data strengthens your models.

- ✅ Choose the Right AI Model: Different models suit different tasks. Machine learning models like logistic regression and random forests are used for credit scoring, while deep learning models are ideal for analysing unstructured data. Choose the model(s) that best fit your organisation’s use cases.

- ✅ Prioritize Model Risk Management: Artificial Intel models can be complex and opaque. Establish robust processes to validate, monitor, and govern your models. Regular testing, independent reviews, and clear documentation of assumptions and limitations are essential to maintaining model accuracy.

- ✅ Embrace Explainable AI (XAI): As regulations evolve, transparency in deep learning decision-making is crucial. ensures your systems are understandable and compliant with regulations like the Fair Credit Reporting Act (FCRA).

- ✅ Develop a Strong Understanding of Risk Modelling: It enhances risk modelling, enabling more sophisticated and accurate models. Use generative Artificial Intelligence for synthetic data and machine learning to uncover complex relationships between variables and AI risk mitigation factors.

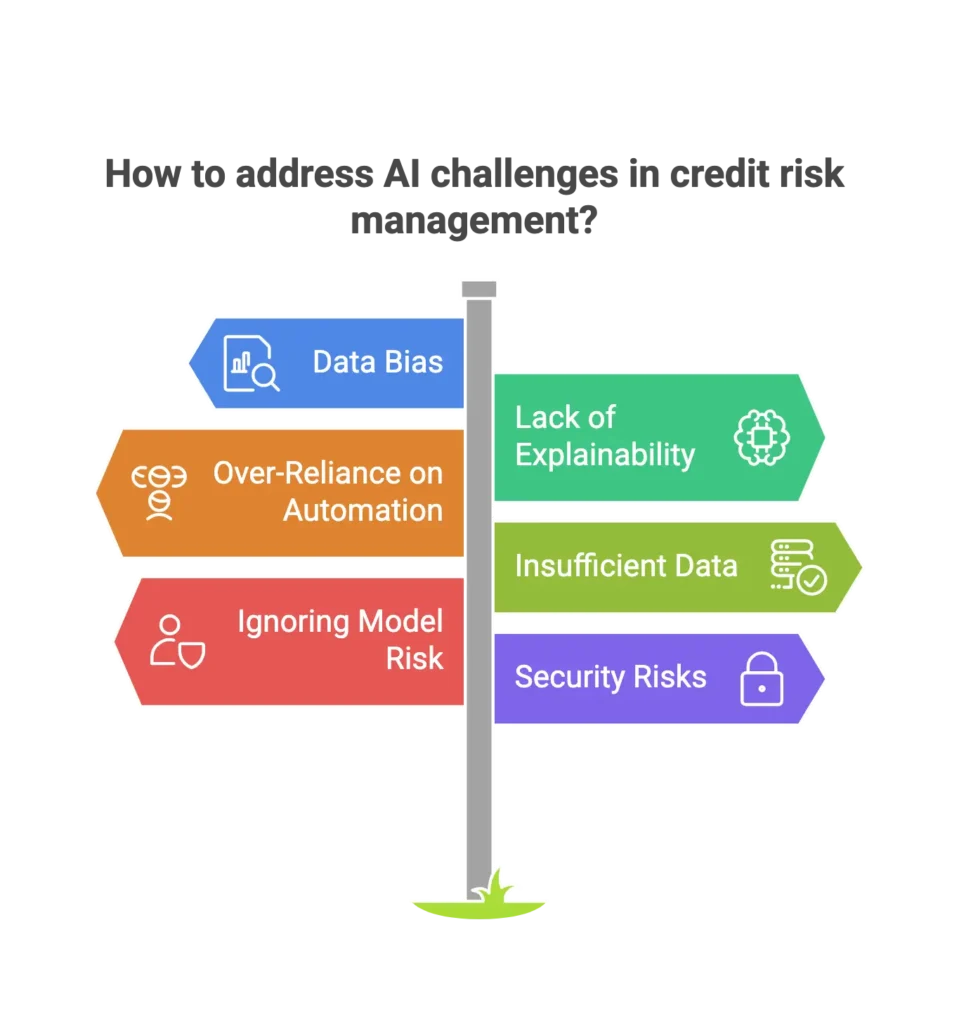

AI in Credit Risk Management: Common Pitfalls to Avoid

While AI offers tremendous benefits, there are key challenges to avoid:

- Data Bias: Intelligent models trained on biased data can perpetuate unfair lending practices. Regularly audit your data for bias and implement strategies to mitigate it.

- Lack of Explainability: “Black box” models can be hard to interpret, raising regulatory and ethical concerns. Aim for Explainable Models (XAI) to ensure transparency and clarity in decision-making.

- Over-Reliance on Automation: While it can automate many processes, human oversight is crucial. Credit analysts should review high-value loans or complex cases to ensure decisions are sound.

- Insufficient Data: Intelligent models need large, high-quality datasets. Inadequate or poor-quality data will impact the performance and accuracy of your models.

- Ignoring Model Risk: Failing to manage model risk can lead to financial losses and reputational damage. Continuously monitor and validate models to reduce these risks.

- Security Risks: With vast amounts of confidential data, ensuring strong cybersecurity protocols is critical to protect sensitive information.

To overcome these challenges, focus on improving data quality, prioritize explainable AI, and implement robust model risk management. Remember, AI is a powerful tool, but it must be used responsibly and ethically.

Industry Trends & Market Insights

Advanced technologies in AI in credit risk management and AI in finance are evolving quickly. Key trends to watch include

- Alternative Data Adoption: Lenders are incorporating alternative data, such as social media activity and utility bill history, into their assessments.

- Rise of Explainable AI (XAI): With growing regulatory demands, XAI techniques are becoming more crucial for transparency.

- Cloud-Based Advanced Technologies Solutions: Cloud computing is making advanced technologies more accessible and affordable for financial institutions.

- Real-Time Risk Monitoring: Machine learning systems allow lenders to monitor and react to risks in real time.

- Generative AI for Synthetic Data: Generative models create synthetic data to train advanced technologies models while protecting privacy.

- Increased Regulatory Scrutiny: Global regulators are focusing more on the use of advanced technologies in financial services, especially for credit management.

These trends underscore the growing role of machine learning systems in finance. Embracing these advancements will help businesses and investors manage risk and make informed decisions. According to the Bank for International Settlements (BIS), the use of advanced technologies in financial services is expanding, especially in credit risk.

Leveraging AI in Credit Risk Management: Smarter Financial Strategies

In modern finance, artificial intelligence is transforming how we leverage AI in credit risk management. At Forbes Le Brock, we specialize in asset-based lending and recognize that today’s risk landscape demands more than traditional methods. AI-driven insights can enhance decision-making and optimize financial strategies.

Here’s how AI in credit risk management is reshaping:

- Smarter Risk Analysis: AI-powered tools process vast amounts of financial data, providing deeper insights into borrower behaviour, market trends, and risk factors. This leads to more accurate risk assessments.

- Enhanced Credit Scoring: Machine learning improves traditional scoring models by incorporating alternative data sources, offering a more complete picture of risk.

- Predictive Decision-Making: Advanced analytics help financial institutions anticipate potential risks, improve compliance, and refine lending strategies.

- AI-Driven Efficiency: Automation streamlines credit assessments, reducing manual work and improving decision-making speed.

By adopting AI-powered solutions, businesses can respond to market shifts faster, make better-informed lending decisions, and manage risk more effectively. As technology evolves, its role in credit risk will continue to expand, offering smarter and more proactive financial strategies.

Key Takeaways

- ✅ AI-driven tools are revolutionising credit risk management by offering accurate risk assessments, faster decisions, and reduced losses.

- ✅ Successful machine learning implementation requires quality data, the right models, and strong risk management.

- ✅ Common challenges include data bias, explainability issues, and over-reliance on automation.

- ✅ Key industry trends include the use of alternative data, rise of explainable AI, and increased regulatory oversight

- ✅ Forbes Le Brock harnesses predictive insights to optimize credit risk management strategies for clients.

- ✅ Staying informed on evolving intelligent technologies is crucial for financial success.

- ✅ The importance of advanced analytics in modern finance will only continue to grow.

Conclusion & Next Steps

The integration of AI in Credit Risk Management is no longer just a trend, it is essential for anyone aiming to protect and grow their wealth or optimize corporate financial strategies. AI in Credit Risk Management offers clear benefits, from detecting fraud to making more accurate credit decisions. Analyzing both structured and unstructured data provides insights that were previously out of reach. However, succeeding in this space requires both expertise and a strategic approach.

Don’t let outdated methods leave you vulnerable. Harness the power of AI-driven, data-based solutions to make smarter decisions, reduce risks, and unlock new opportunities.

💬 Ready to enhance your credit risk management? Contact Forbes Le Brock to discuss tailored financing solutions and how AI-driven insights can work for you. 📩 Contact Us Today!

Serving clients across the UK, Europe, and Asia-Pacific.

FAQ: AI in Credit Risk Management Using Advanced Technologies

Q1: What does AI in credit risk management mean?

Credit risk management powered by artificial intelligence involves using sophisticated algorithms and machine learning techniques to evaluate creditworthiness and predict the likelihood of loan defaults. It blends traditional financial data with alternative sources to develop more dynamic and accurate risk profiles.

Q2: How does advanced technologies enhance credit risk assessment?

By processing large volumes of data, including social media sentiment and real-time market news, advanced technologies uncover patterns that humans might miss. This leads to more precise evaluations of potential risks and better-informed lending decisions.

Q3: What are the benefits of applying AI in credit risk management?

Machine learning tools improve risk assessments by offering faster decision making, more accurate fraud detection, and better regulatory adherence. These tools also optimize portfolio performance and reduce the occurrence of bad loans.

Q4: What challenges arise when implementing machine learning models in credit risk management?

Key challenges include addressing data bias, ensuring that models are transparent and understandable, and avoiding over-reliance on automated decision making. Regular model validation and improved data quality are essential for mitigating these issues.

Q5: What is model risk management in AI-driven finance?

Model risk management involves validating and monitoring predictive models to ensure they are accurate, reliable, and compliant with industry standards. Regular testing and independent reviews help mitigate risks tied to using machine learning models in financial decision making.