AI in Finance: Transforming the Future of Financial Services in 2025

By 2027, AI-powered financial services are projected to generate over $1 trillion in annual value, those who lag risk falling irreparably behind. Source: Bloomberg

AI in finance is revolutionising the financial sector, enhancing decision making, risk assessment and operational efficiency. From algorithmic trading to fraud detection, AI is reshaping how financial institutions operate, offering greater accuracy, speed and cost effectiveness. As adoption accelerates across banking, investment management and insurance, the role of AI in finance is no longer experimental. It is now foundational. Understanding its capabilities, limitations and risks is essential for firms looking to stay competitive and compliant in an increasingly digital financial landscape.

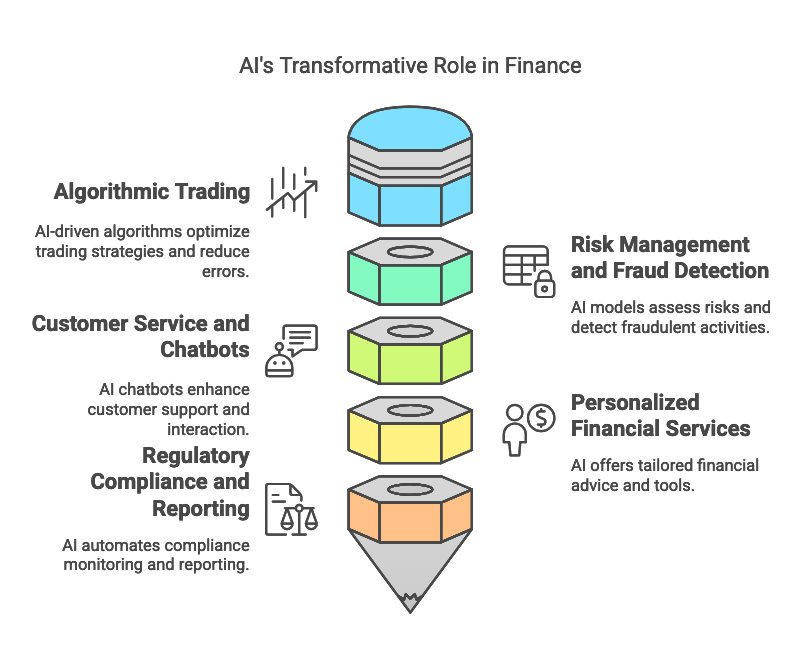

AI in Finance: 5 Key Applications

AI in finance is already embedded in the core functions of financial institutions. From front office automation to back office optimisation, it is helping firms make faster decisions, reduce errors, and improve client outcomes. This section outlines the most important ways AI is being used across finance today, from credit risk to fraud detection and beyond.

1. Algorithmic Trading

AI-driven trading systems analyse massive volumes of real time and historical market data to identify pricing inefficiencies and patterns. These algorithms are capable of executing high frequency trades within milliseconds, reducing latency and human error. By continuously learning from market movements, they can adjust strategies dynamically, giving traders a competitive edge and improving portfolio returns.

2. Risk Management and Fraud Detection

AI plays a central role in identifying credit risk, operational risk and potential fraud. By processing customer data, transaction patterns and macroeconomic indicators, machine learning models can flag anomalies or predict the likelihood of default more accurately than traditional scoring systems. In fraud detection, AI in finance can spot irregular behaviours such as unusual login times and suspicious transaction sequences, often in real time, allowing institutions to respond before losses occur.

3. Customer Service and Chatbots

AI-powered virtual assistants are now standard in many banks and fintech platforms. These systems can resolve customer queries, update account information, and perform routine actions such as resetting passwords or scheduling payments. Using natural language processing (NLP), they understand the context of customer interactions, improving the quality of service and reducing the strain on human support teams.

4. Personalised Financial Services

AI in finance allows firms to deliver customised financial advice based on an individual’s income, spending habits, investment preferences and life goals. Robo-advisors, for example, can recommend portfolios that reflect a user’s risk tolerance and timeline, while banking apps use AI to deliver personalised budgeting tips, saving nudges or credit alerts. This leads to more engaged clients and better financial outcomes.

5. Regulatory Compliance and Reporting

AI assists compliance teams by automating tasks such as transaction monitoring, document scanning and regulatory reporting. It can track evolving legislation and apply rule based logic to ensure that the institution remains compliant across multiple jurisdictions. This not only reduces the risk of fines but also cuts down the time and resources needed to manage complex compliance workflows.

Benefits of AI in Finance

- Smarter Decision Making: AI analyses vast datasets to improve the accuracy of credit assessments, risk modelling and investment strategies.

- Operational Efficiency: Automated workflows streamline back office processes, reducing approval times and manual errors across lending, compliance and reporting.

- Reduced Costs: By automating routine tasks, institutions cut labour intensive overheads and reallocate resources to higher-value activity.

- Stronger Fraud Protection: AI continuously monitors transactions and behaviour, detecting anomalies in real time and improving cyber threat response.

- Scalability: AI systems support rapid growth, allowing firms to handle larger volumes without a proportional increase in cost or headcount.

Challenges and Ethical Considerations

- Data Privacy and Security: AI systems depend on sensitive financial data, demanding robust safeguards to meet legal and ethical standards.

- Algorithmic Bias: Poor training data can embed social or economic bias into credit scoring and investment models, potentially leading to unfair outcomes.

- Regulatory Complexity: The pace of AI development often outstrips regulation, leaving financial firms exposed to compliance uncertainty.

- Transparency and Accountability: Many AI models operate as ‘black boxes’, making it difficult to explain decisions or audit outcomes effectively.

- Reliance on Automation: Over-dependence on AI can erode human oversight, especially during market stress or system errors.

Conclusion: AI in Finance is Not Optional

AI in finance is no longer a futuristic concept, it’s a fundamental force reshaping the financial sector. From algorithmic trading and credit risk assessment to fraud detection and client personalisation, artificial intelligence is streamlining operations and unlocking new strategic possibilities. Financial institutions that integrate AI effectively are already seeing gains in decision-making speed, cost efficiency, and risk mitigation.

However, the advantages come with caveats. Bias in machine learning models, data privacy risks, and opaque decision-making processes remain serious concerns. Firms must strike a balance between innovation and accountability by investing in transparent systems, robust governance, and human oversight.

The winners in this new financial era will be those who embrace AI not just as a cost cutting tool, but as a strategic enabler of smarter, more resilient operations. The future of finance is intelligent, adaptive, and data-driven, and the time to act is now.

Forbes Le Brock stands ready to help financial institutions harness the full potential of AI, turning innovation into lasting competitive advantage.

Leaders who champion AI integration today will define the future of finance, there is no time to wait

FAQs: AI in Finance

- What is AI in finance?

AI in finance refers to the use of artificial intelligence technologies, like machine learning, natural language processing, and automation, to improve decision making, risk assessment, customer service, and operational efficiency within financial services. - How is AI used in financial institutions?

Financial institutions use AI for algorithmic trading, fraud detection, credit scoring, customer support (via chatbots), personalised financial advice, and regulatory compliance automation. - What are the benefits of AI in finance?

AI helps reduce operational costs, improve speed and accuracy in decision making, detect fraud in real time, enhance customer experience, and scale services efficiently without adding headcount. - Are there risks or downsides to AI in finance?

Yes. Key concerns include data privacy, algorithmic bias, regulatory uncertainty, lack of transparency in AI decisions, and over-reliance on automation without human oversight. - Is AI in finance regulated?

Regulation is evolving but not yet consistent across regions. Firms must proactively ensure compliance with data protection laws and develop ethical AI frameworks to remain ahead of regulatory developments. - How can a financial institution get started with AI?

Start by conducting an AI readiness assessment, reviewing existing systems, identifying high-impact use cases, and partnering with experienced AI providers like Forbes Le Brock to ensure strategic, compliant implementation.

Next Step: Unlock the Full Potential of AI in Finance

📢 Don’t let legacy systems limit your growth. Harness AI in finance to accelerate efficiency, fuel innovation, and gain a decisive competitive edge. Serving clients across UK, Europe & Asia-Pacific

📅 Schedule Your AI Readiness Assessment Now and start transforming your financial operations for tomorrow’s challenges.

🔊 No time to read? Tune into the Deep Dive: How AI in Finance Transforms Financial Services in 2025 🎧Catch it now!