AI Trading Fraud: Top Strategies to Combat Attacks in 2025

The Double-Edged Sword of Risks in AI in Finance and Investments

Artificial Intelligence is undeniably reshaping the financial landscape. From algorithmic trading and risk management to personalized wealth advisory, the potential for efficiency gains, smarter decisions, and competitive advantage is immense. For investors, high-level decision-makers, and High Net Worth Individuals (HNWIs), leveraging these powerful systems offers significant opportunity.

However, this same technology carries a serious downside: the rise of sophisticated AI trading fraud.

As we approach 2025, the very tools driving growth are being weaponised by malicious actors. The surge in financial fraud involving advanced algorithms is not just a trend; it’s an escalating threat that demands strategic focus at the highest levels. Understanding and proactively combating AI in finance is no longer optional, it’s critical for protecting assets, preserving investor confidence, and safeguarding reputations.

This post explores the evolving nature of AI trading fraud, the tactics scammers use, and the top strategies you need for robust fraud prevention in 2025.

AI Trading Fraud: Understanding the Evolving Landscape

The term AI trading fraud encompasses a range of deceptive practices where sophisticated software is used, either directly or as a lure, to perpetrate investment fraud. Scammers leverage the hype around artificial intelligence and its perceived complexity to create convincing schemes that prey on investors seeking high returns.

What Constitutes AI Trading Fraud?

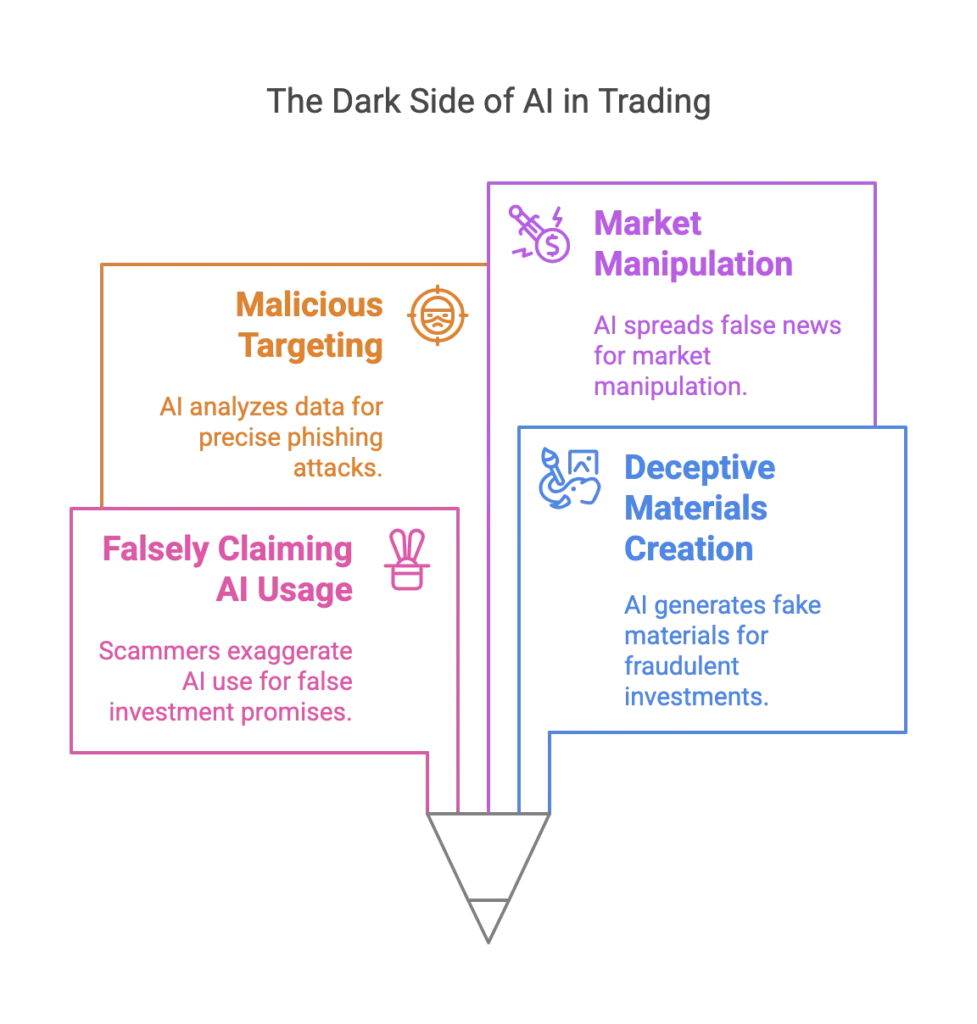

At its core, AI trading fraud involves misrepresentation. This can manifest in several ways:

- Falsely Claiming Usage of Advanced Algorithms: Scammers promote investment platforms or strategies, claiming to use machine learning or sophisticated technology to generate exceptional returns with little or no risk. In reality, the intelligent component may be non-existent or vastly exaggerated.

- Using Generative Models to Create Deceptive Materials: Generative systems can be employed to create fake websites, realistic looking websites or marketing materials, forged performance reports, and even deepfake videos featuring fabricated endorsements. Scammers use these advanced tools to create highly convincing facades for their fraudulent opportunities.

- Employing Smart Technology for Malicious Targeting: Certain tools can analyse vast datasets to identify and profile potential victims, tailoring phishing attacks or social engineering schemes with alarming precision.

- Algorithm-Powered Market Manipulation: While still emerging, concerns exist about bad actors using computational intelligence to spread false news or manipulate market sentiment for illicit gains, potentially impacting legitimate trading securities.

The popularity and complexity of these technologies make these scams particularly insidious, as victims may feel intimidated by the systems or overly trust claims backed by sophisticated-sounding jargon.

Why is AI Trading Fraud Escalating?

Several factors contribute to the alarming increase in finance deception leveraging advanced algorithms:

- The “Intelligent Tech Gold Rush”: The intense hype around machine learning creates an environment where investors are eager to capitalise on the next big technological wave, sometimes lowering their guard. Bad actors often use the hype around new technological developments to their advantage.

- Accessibility of Sophisticated Tools: Powerful software, including generative models, is becoming more accessible and user-friendly, lowering the barrier for scammers to use this technology to create fake content and automate fraudulent activities.

- Sophistication of Deception: Advanced systems can guarantee amazing returns – or so the scammers claim. Generative software enables the creation of highly personalized and convincing hoaxes, making them harder to detect than traditional fraud. They can produce realistic looking websites or marketing materials to promote fake offerings.

- Anonymity and Scale: These technologies allow scammers to operate at scale, targeting vast numbers of potential victims across geographical boundaries with relative anonymity.

- Complexity as a Shield: The inherent complexity of machine learning can be used to lure victims, making it difficult for non-experts to verify claims or understand the underlying (often non-existent) technology.

Common Tactics Used in AI Trading Fraud

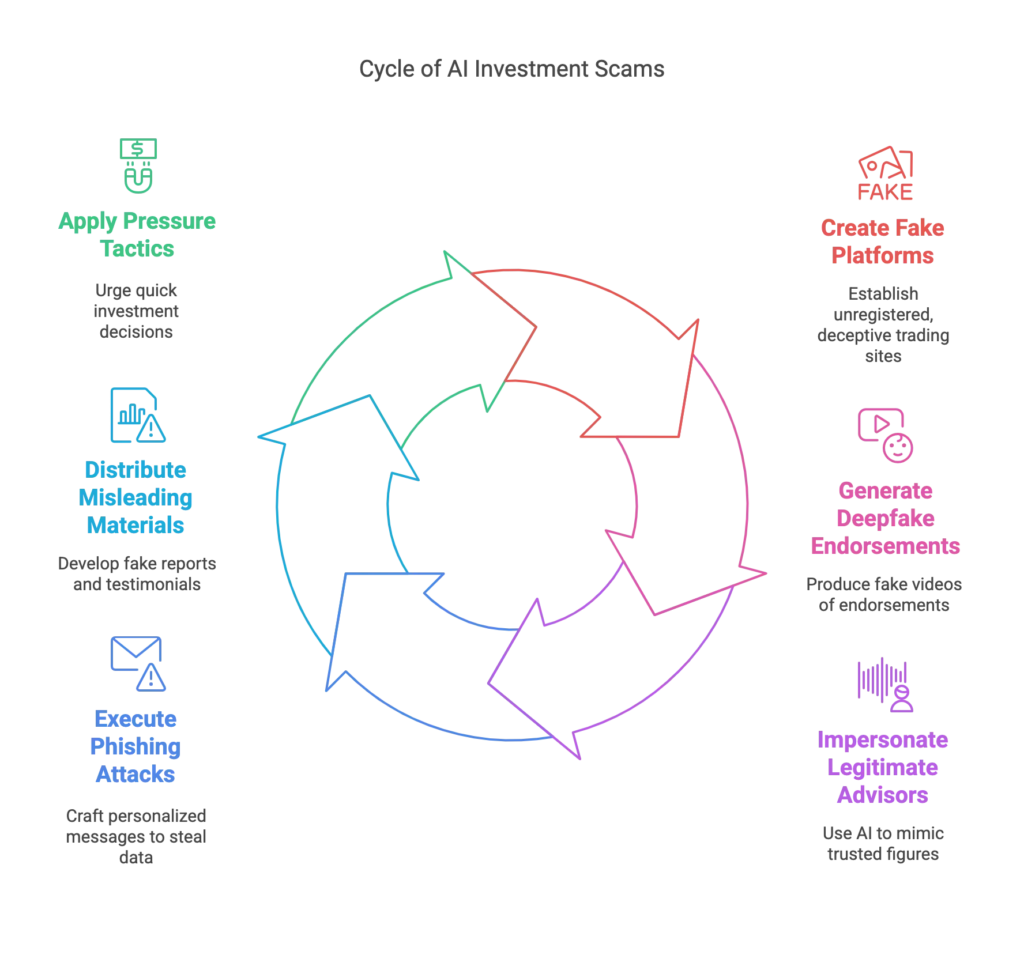

Vigilance requires recognising the methods employed by fraudsters. Key tactics include:

- Fake Algorithmic Trading Platforms: Slick, professional-looking websites promising proprietary trading systems powered by advanced algorithms that deliver impossibly high or guaranteed returns with little or no risk. These platforms are often unregistered.

- Deepfake Endorsements: Scammers use generative software to create fake videos of prominent figures (CEOs, celebrities, financial gurus) seemingly endorsing a fraudulent scheme. Imagine a deepfake video of the CEO of a company announcing false news about a partnership to pump a worthless stock.

- Impersonation Scams: Using machine generated scripts and voice cloning to impersonate legitimate financial advisors, brokers, or representatives from well-known institutions, often contacting victims via social media, email, or messaging apps. This is sometimes used in relationship scams.

- Phishing and Data Harvesting: Employing intelligent automation to craft highly personalised phishing emails or messages designed to steal login credentials for legitimate accounts or financial trading platforms.

- Misleading Marketing Materials: Using machine generated content to create impressive but entirely fabricated performance reports, white-papers, and testimonials for non-existent products or funds leveraging computational intelligence.

- Pressure Tactics: Combining algorithm driven outreach with classic high pressure sales tactics, urging immediate decisions to capitalise on a supposedly limited time opportunity powered by smart technology.

These tactics often prey on the fear of missing out (FOMO) associated with the rapid advancements in these powerful technologies.

Combating AI Trading and Financial Fraud

Protecting assets and maintaining trust in the age of intelligent systems requires a multi-layered defense strategy. Effective fraud prevention in 2025 hinges on technology, diligence, education, and regulatory awareness.

Enhancing Due Diligence in the Age of Advanced Algorithms

The fundamentals of investment scrutiny remain paramount, perhaps even more so given the potential of these systems to obfuscate:

- Verify, Then Trust: Never take claims at face value, especially unsolicited offers. Independently verify the legitimacy of any investing platform or advisor.

- Check Registration Status: This is non-negotiable. Use resources like the SEC’s IAPD database or FINRA’s BrokerCheck to confirm the registration status of finance and investing professionals and firms. Remember, securities laws generally require securities firms and professionals dealing with the public to be registered. The promoter’s lack of registration status is a major red flag.

- Scrutinise Promises: Be deeply skeptical of guarantees. Legitimate opportunities always involve risk. Claims that sophisticated software can guarantee amazing returns or offer high returns with little or no risk are classic warning signs of fraud.

- Question the “Secret Sauce”: While firms protect proprietary algorithms, overly vague or evasive answers about how their supposed technology works should raise concerns. Understand the basic strategy being proposed.

- Look Beyond the Website: Scammers use generative tools to create convincing online presences. Look for physical addresses, regulatory filings, independent reviews, and company history. Be wary if information is scarce or inconsistent.

Leveraging Technology for AI Fraud Prevention

Fighting fire with fire is a key component of combating AI financial fraud:

- Intelligent Fraud Detection: Implement sophisticated software tools designed to detect anomalies in transactions, user behaviour, and communication patterns that may indicate fraudulent activity. Machine learning can identify subtle deviations that rule-based systems might miss.

- Advanced Authentication: Utilise multi-factor authentication (MFA), biometric verification, and behavioral biometrics to secure accounts and platforms against unauthorised access.

- Deepfake Detection Technology: Explore and invest in emerging technologies designed to identify machine-generated or manipulated media (images, videos, audio).

- Cybersecurity Infrastructure: Maintain robust cybersecurity defenses, including advanced endpoint protection, network monitoring, and regular vulnerability assessments, to protect against malware and phishing attacks used to facilitate AI trading fraud.

- Data Analytics for Threat Intelligence: Use data science and machine learning to analyse threat intelligence feeds, identifying emerging fraud typologies leveraging computational intelligence and attack vectors proactively.

The Critical Role of Human Oversight and Education

Technology alone is insufficient. Human intelligence and vigilance remain crucial:

- Investor Education: Proactively educate clients and stakeholders about the risks of AI trading fraud. Share resources from leading regulatory bodies like the UK’s Financial Conduct Authority (FCA) and the European Securities and Markets Authority (ESMA). These agencies publish guidance on fraud tactics, red flags, and investor protection. Educating clients through official channels like FCA ScamSmart and ESMA’s Investor Corner is one of the most effective defenses against AI-driven financial scams.

- Internal Training: Equip employees, particularly client facing teams and compliance officers, to recognize the signs of cons leveraging advanced technology, including sophisticated social engineering attempts and doctored documentation.

- Critical Thinking: Foster a culture of skepticism. Emphasise that no finance decision should be made solely based on machine-generated information or flashy marketing. Never make a decision just because someone claims to use smart systems to make money. The idea to make an investment should stem from thorough research and understanding.

- The “Human Firewall”: Empower individuals to question, verify, and report suspicious activity. Encourage reporting potential fraud internally and to relevant authorities.

Regulatory Landscape and Compliance

Staying compliant and informed is essential:

- Monitor Regulatory Guidance: Keep abreast of evolving regulations and guidance from bodies like the FCA (Financial Conduct Authority) and ESMA (European Securities and Markets Authority) concerning advanced algorithms in finance and securities fraud.

- Robust Compliance Frameworks: Ensure internal compliance policies and procedures address the specific risks posed by AI trading fraud, including enhanced due diligence protocols for investments or platforms related to these technologies.

- Incident Response Planning: Develop and test incident response plans specifically for scenarios involving fraud attempts driven by intelligent systems or breaches.

- Collaboration and Information Sharing: Participate in industry forums and initiatives focused on sharing threat intelligence related to AI trading fraud and other cyber threats.

Case Study Spotlight: The Deepfake Dilemma

Consider a hypothetical scenario reflecting real world risks: A sophisticated scam operation uses generative software to create a highly realistic deepfake video. In the video, the respected CEO of a major tech firm appears to enthusiastically endorse a new, obscure cryptocurrency investment platform, claiming its proprietary algorithmic trading systems yield guaranteed 30% monthly returns.

The video is disseminated rapidly via social media and targeted email campaigns identified using profile analysis driven by intelligent software. The scammers use the CEO’s credibility and the hype around advanced technology to lure victims. Investors, impressed by the seemingly legitimate endorsement and the promise of high returns, pour funds into the fake platform. Weeks later, the platform vanishes, along with the investors’ capital.

Lessons Learned:

- Verification is Crucial: Even seemingly authentic video endorsements require independent verification, especially if promoting high risk or unregistered investment opportunities.

- Source Matters: Consider the channel through which information is received. Unsolicited investment advice, even if appearing to come from a trusted source, warrants extreme caution.

- Unrealistic Returns = Red Flag: The promise of guaranteed high returns remains one of the most reliable indicators of potential investment fraud, regardless of the technology claimed.

Future Outlook: The Continuous Arms Race Against AI Trading Fraud

The battle against AI trading fraud is not a one time fix but an ongoing arms race. As sophisticated technology continues to evolve, so too will the methods employed by bad actors. We can anticipate:

- Increased Sophistication: Scams will become even more personalised, convincing, and difficult to detect. Bad actors are using the growing popularity and complexity of these systems relentlessly.

- Novel Attack Vectors: Fraudsters will find new ways to exploit computational intelligence, potentially targeting smart contracts, decentralised finance (DeFi) platforms, or leveraging these tools for more complex market manipulation schemes.

- Regulatory Catch-Up: Regulators worldwide will continue to adapt, introducing new rules and enforcement actions specifically targeting the misuse of advanced algorithms to commit fraud.

- Ethical Technology Development: A greater push towards developing and deploying intelligent systems ethically, with builtin safeguards against misuse, will be crucial.

Staying ahead requires continuous investment in technology, ongoing education, adaptive strategies, and a commitment to vigilance from leadership, employees, and investors alike. Combating AI fraud in finance must be woven into the fabric of risk management and strategic planning.

Conclusion: Strengthening Financial Resilience in the Age of AI

Advanced computational systems offer transformative potential for the financial industry and those who navigate it. However, the shadow of AI trading fraud looms large, threatening capital, reputations, and the very trust upon which the financial system is built. The increase of investment frauds involving these technologies necessitates a proactive, multi-faceted defense.

For C-suite executives, investors, and HNWIs, the key takeaways are clear:

- Acknowledge the Threat: Recognize that AI trading fraud is a sophisticated and growing danger.

- Prioritize Due Diligence: Reinforce rigorous verification processes for all investment opportunities, especially those heavily promoting advanced algorithms. Check registration and scrutinise promises.

- Invest in Defense: Leverage advanced software tools and cybersecurity measures for fraud prevention in 2025 and beyond.

- Empower People: Foster a culture of vigilance through continuous customer education and internal training. The human element remains critical.

- Stay Informed: Keep abreast of regulatory developments and emerging fraud tactics

Next Steps

AI trading fraud isn’t slowing down, and neither should your response. If you’re serious about protecting capital, enforcing smarter due diligence, and future proofing your investment strategy, now’s the time to act. Let’s talk.

Serving clients across UK, Europe & Asia-Pacific Book a call today to assess your risk exposure and implement proactive strategies to protect your financial future.

🎧 Prefer to listen? Check out this Deep Dive on AI Trading Fraud: Top Strategies for 2025🎙️Listen here